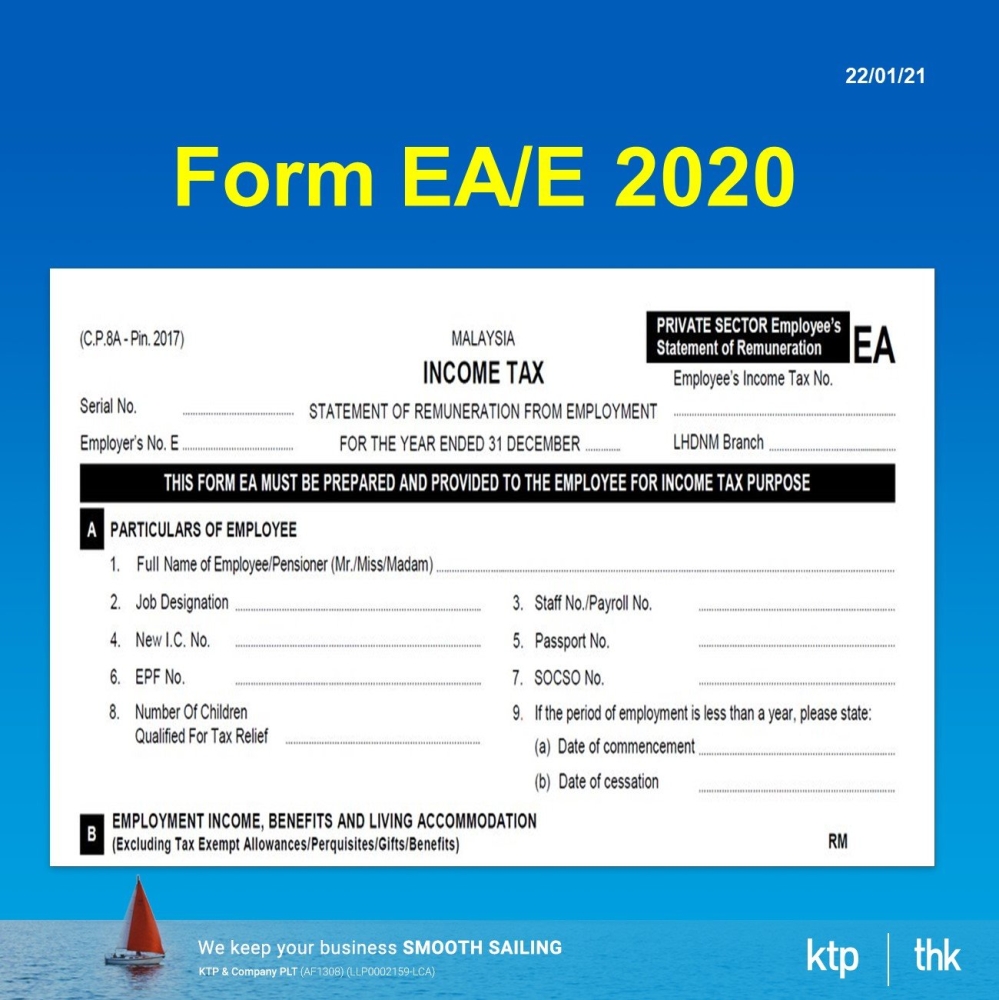

Tax

When can i submit Form E 2020?

Due Date - Give Employee a Copy of Form EA

28 February 2021

Due Date - Submit Form E to IRB

31 March 2021

E Filing of Form E 2020

-

Companies: Compulsory

-

Others type of companies : Encourage to use E filing but not compulsory

Start : 1 March 2021

E-Data Praisi

Employer, who is under E-Data Praisi, is exempted for Form EA (ie CP8A)

Exemption on Form EA 2020

Sole Proprietorship, partnership who don’t have any employee

Source : No 13 of E 2020 explanatory note

Question on Form EA

Form EA is applicable to ALL employee?

* Answer in the comment section! We will come back in due course.

Visit us www.ktp.com.my

Visit us www.thks.com.my

Have you CP58?

What is the CP58?

It is a statement of monetary & non-monetary incentive payment to an agent, dealer or distributor pursuant to Section 83A of the Income Tax Act 1967.

CP58 has 2 categories:

1. Monetary payment: Payment in cash. For examples, commission and bonus.

2. Non monetary payment: Included car, house, travel ticket, accommodation, ground tour, food & drinks.

Who are required to prepare CP58?

All companies need to prepare and render to its agents, dealers and distributors if the amount of monetary and non monetary incentive exceeds RM5,000.00 during the calendar year.

When to submit CP58?

Furnish to agent, dealer and distributor before 31st March on the following year;

Furnish to LHDN - Only need to submit upon request by IRB.

What if you fail to furnish CP 58 to LHDN during the notice in writing?

Failure to furnish is an offence under subsection 120(1) of the Income Tax Act 1967.

Payer company liable fine of not less than RM200.00 and not more than RM20,000.00 or to imprisonment for a term not exceeding six months or both.

However, if LHDN request for listing of CP58 information, a taxpayer company is required to submit all information including amounts below RM5,000.00

IRB Official Guideline on CP58

Visit us www.ktp.com.my

Visit us www.thks.com.my

Tax incentive for food production

[Latest update] (which is super long overdue ?!🤣😅)of tax incentive for food production

Timeline of the incentive for food production

1. YAB Dato' Sri Mohd Najib Tun Haji Abdul Razak, Prime Minister and Minister of Finance tabled The Budget 2016 on the 23rd October 2015.

2. INCOME TAX (EXEMPTION) (NO. 6) ORDER 2020 P.U. (A) 373/2020 was gazetted on 24th December 2020.

3. INCOME TAX (DEDUCTION OF INVESTMENT IN NEW FOOD PRODUCTION PROJECT OR EXPANSION PROJECT) RULES 2020 P.U. (A) 374/2020 was gazetted on 24the December 2020.

Things to do (if you are in the food production industry)

1. Discuss with your tax agent

2. Apply the tax incentive with MOA.

3. Resubmit the tax return once MOA approve the application of tax incentive.

4. Wait for tax audit.

5. ....

Overview of the tax incentive for the food production

Income Tax (Exemption) (No. 6) Order 2020

Effective Date : 1 Jan 2016

Salient Points :

(A)100% exemption on statutory income on new food production project for 10 consecutive YAs.

Application is to be made to the Ministry of Agriculture and Food Industries (MOA) between 1 January 2016 until 31 December 2020.

The project must not have commenced on the date of making the application.

(B) Expansion project that is approved by the Minister in relation to the new food production project in (a) above, for 5 consecutive YAs.

The scope of new food production include planting of industrial crop and cash crop, rearing of deer, rearing of honey and urena lobata bees, and planting of feed mill & etc.

Income Tax (Deduction of Investment in New Food Production Project or Expansion Project) Rules 2020

Effective Date : 1 Jan 2016

Salient Points :

(A)Provides tax deduction equivalent to the value of investment (in cash or ordinary share capital) made in a related company that undertakes a new food production or expansion project approved under the Income Tax (Exemption) (No. 6) Order 2020 (“qualifying project”)

(B) Application is to be made to the MOA between 1 January 2016 until 31 December 2020.

(C) The deduction for a YA shall be equivalent to the expenditure incurred by the related company for the qualifying project in the basis period for the same YA, and for a period approved by the Minister.

(D) The deduction shall cease in the YA the related company commences its tax exemption period upon having its first statutory income from the qualifying project.

(E) For investments in ordinary shares, the deduction claimed will be clawed back if the investment is disposed of within 5 years from the date of investment. The disposal consideration shall be added to the adjusted income of the company in the YA it is received but shall not exceed the total deduction claimed in relation to the investment

#ktp

#thk

#taxincentive

#foodproduction

#IRB

#MOA

Visit us www.ktp.com.my

Visit us www.thks.com.my

Budget 2021 Malaysia - Key Summary of Company

The tax highlights of Budget 2021 include:

-

Preferential corporate income tax rate of 0% to 10% for 10 years for manufacturers of pharmaceutical products

-

Extension and expansion of existing tax incentives that have worked well. In particular, the preferential tax rates of 0% to 10% for selected manufacturers to relocate their operations to Malaysia will be extended to companies in selected services sectors and the application period will be extended to 31 December 2022.

-

& more...

Download KTP Ebook on Tax Budget 2021 Key Summary for Company

Visit us www.ktp.com.my

Visit us www.thks.com.my

How to record construction in progress journal entry?

Confused over construction accounting Q&A Part III

Today we cover Q&A #3 on recognition and measurement in the construction accounting following our first sharing on the business cycle in last week.

We will run a series of our training note to our clients and new colleagues on contract accounting. Stay tune

Next is the tax treatment on the construction account.

Step by step on construction accounting.

#1 Determine the % of completion

1.1 Progress bill method

= Actual work done to date/contract sum

… OR

1.2 Cost method

= Actual work done to date/budgeted cost

#2 Revenue Recognition = % of completion x contract sum

#3 Cost recognition = % of completion x budgeted cost

#4 Amount due / (to) from customer

#5 Disclosure on financial statement in construction accounting

5.1 Recognition method used

5.2 Amount due/(to) from customer

Visit us www.ktp.com.my

Visit us www.thks.com.my

Tax obligation for Employer for New & Resigned Employee 2021

IRB has changed new forms on with effect from 1/1/2021.

1. CP21 - Notification by Employer on Employee's departure from Malaysia

2. CP22 - Notification of New Employee

3. CP22A - Notification of Cessation of Employment

Penalty on non compliance on CP21, CP22 & CP22A

Delay in submitting the application for tax clearance may be subjected to penalty. The penalty will be in the form of fines between MYR 200 and MYR 20,000 and imprisonment for up to six months.

LHDN may take legal action against the employer who fails to pay the outstanding tax as per the Tax Clearance Letter.

Visit us www.ktp.com.my

Visit us www.thks.com.my

Tax Filing Deadline 2021

Click Here: Filing Due Dates for 2021 (YA2020)

Visit us www.ktp.com.my

Budget 2021 Malaysia - Key Summary of Individual

The tax highlights of Budget 2021 include:

- Reduction in personal income tax rate by one percentage point for tax resident individuals for chargeable income in the band of RM50,001 to RM70,000

- Preferential 15% personal tax rate for non-Malaysian citizens holding key positions in companies that relocate their operations to Malaysia under the PENJANA incentive package

- & more

Click here: KTP Ebook on Tax Budget 2021 Key Summary for individual

Accrued Directors Fees Tax Treatment Malaysia

Why I have to PAY TAX even though not yet received my money???

Mr X (Director): Aiya..I haven’t received my director fee which accrued in YR2019 account because of this Covid-19.

Mr K (Tax Agent): Oh.. So sad to hear about this.. But, did you pay your PCB for the accrued director fee?

Mr X (Director): Why I need to pay??? I haven’t received my director fee!!!

Mr K (Tax Agent): You are required to do so if you are the person who has the right to control the company.

Mr X (Director): …… Yes, I am.

Mr K (Tax Agent): So, your director fee which accrued in Year 2019 is required to

- pay PCB before 15.01.2021 and

- reported in Year 2020 Form EA before 28.02.2021.

Deemed income provision under Income Tax Act

If you met the conditions under S29(4) of ITA:-

a) Persons one of whom has controlled over the otherb) Individual who are relatives of each other

c) Person both of whom are controlled by some other persons

So, the “income” is required to declare in the Income Tax Return Form even though it is not yet received.

Director Fee (Past vs Now)

In the past, the directors receive the directors fees are not taxed on them until they are actually received,

But...

With effect from 2016, irrespective of whether the directors’ fees/bonus are actually paid in cash from the company bank account, or credited to the directors’ loan account...

... 𝐃𝐄𝐄𝐌𝐄𝐃 𝐑𝐄𝐂𝐄𝐈𝐏𝐓 is applicable.

It mean the directors must declare his/her director fee in personal tax in the following year.

Real Story of Deemed Income Provision under S29 (4) of the Income Tax Act

Given #1 Kena Tax Sdn Bhd Balance Sheet show :

- Accrual of director fee since 2018 RM100,000

-

Accrual of director fee since 2019 RM150,000

-

Accrual of director fee since 2020 RM200,000

Given #2 Director of Kena Tax Sdn Bhd never pay the personal tax on the director fee (assuming not yet receipt).

Given #3 Kena Tax Sdn Bhd never pay PCB on the accrued director fee.

Question to taxpayer;

-

How to appeal to tax officer during tax audit on such accrual director's fee?

-

Does IRB officer has the right to add back those accrued director fee in Kena Tax Sdn Bhd?

Trivial of Deemed Income Provision

PS #1 : Why our tax people always ask directors on the reporting of director fee?

PS #2 : Why our account people always review accrual account in the balance sheet for Form E compliance work?

𝐒𝐨𝐮𝐫𝐜𝐞𝐬 of Deemed Income Provision

Income Tax Act 1967 – Section 29(4) Basis period to which income obtainable on demand is related

Visit us www.ktp.com.my

Visit us www.thks.com.my

Can interest expense be deducted?

The accountant helps the boss to deduct interest expense on new warehouse for own business. Boss wants to buy new warehouse. But worry about the tax deduction on new borrowing on the proposed warehouse.

Interest definition as per IRBM

The return or compensation for the use or retention by a person of a sum of money belonging to or owed to another.

Tax treatment of interest expense

Deductibility of interest expense under paragraph 33(1)(a), in ascertaining the adjusted income of a person from a source for the basis period for a year of assessment, interest incurred and payable on money borrowed by that person and -

(i) employed in that period in the production of gross income from that source; or

(ii) laid out on assets used or held in that period for the production of gross income from that source

Example on interest expenses is an allowable expense

ABC Sdn Bhd which closes its account on 31 December every year borrowed RM10 million from Maybank in March 2008 to build a new factory for its own use.

The building is expected to be completed in January 2010.

Although the building has not yet been completed in the years 2008 and 2009, the interest expense incurred by the company in those years are allowed a deduction from its gross business income for the years of assessment 2008 and 2009 respectively.

The loan was laid out on asset held for the production of income.

Borrowing not used in business

Borrowed money not wholly and exclusively used in business like investment in property, shares, securities, interest free loan..

Interest is not deductible expenses

Pre-commencement of business

A person would not be given any deduction on the interest expense which he has incurred on borrowed money to construct a building or plant prior to commencement of his business.

Source : IRBM Public Ruling 2/2011 Interest Expense and Interest Restriction

Visit us www.ktp.com.my

Visit us www.thks.com.my

IRB to stop receiving payments via posted cheques from Jan 1

IRB的最新裁定 - 过帐支票来纳税

请观看此视频1分钟视频更新@ KTP Youtube

Tax and Secretarial Fee Tax Deduction Malaysia 2020

New rules are coming to town!! Changes in tax treatment of secretarial and tax filing fees.

Overview

On 18.09.2020, the IRB had issued a technical guideline on tax deductions for secretary and tax agent fees effective from YA2020.

Key takeaway

- What is the current practice (YA 2019 and before)?

- Changes in year 2020 onwards

-

What is the secretarial fee?

- Deductible

- NOT deductible

- What is tax filing fees?

Summary of learning

What is current practice (YA 2019 and before)?

Expenses incurred on secretarial and tax filing fees give a tax deduction of up to RM5,000 and RM10,000 respectively for each year of assessment (YA).

Changes in year 2020 onwards

Secretarial and tax filing fees being combined, such that a total deduction of up to RM15,000 per YA be allowed for both expenses from YA 2020 onwards.

Scenario:

ABC Sdn. Bhd. has received following invoices for financial year end is 31 December 2020 and made payment as follows:

What is the secretarial fee?

Secretarial fee charged in respect of secretarial services to comply with the statutory requirements under the Companies Act 2016 is deductible as follows:

- Lodgement of annual return and Financial statements.

- Change of name

- Add or delete business activities

- Retainer fees

- Issuance or transfer of shares

- Update register of members and directors

- Appointment of director or auditor

*Condition to be made: Must be incurred and paid

General secretary charges NOT deductible:

- Incorporation fee for new company (include professional fees)

- Fee for acquisition of shelf company (include professional fees)

- Name search fee to SSM (include professional fees)

- Preparation of registration documents

- Company profile printout from SSM

- Professional fee for preparation of ordinary/ special resolution

- Professional fee for preparation of other resolution, confirmation letter to bank or solicitor

- Professional fees for preparation of trust deed

- Preparation fees for CTC documents

- Attestation fees for commissioner for Oaths

What is tax filing fee?

A tax agent approved under the Income Tax Act 1967 (ITA) in respect of services provided for the:

- Preparation and submission of income tax returns

- Estimate of tax payables

A person in respect of services provided for the preparation and submission of returns in the prescribed form for the purposes of:

- Section 26 of the Sales Tax Act 2018

- Section 26 of the Service Tax Act 2018

- Section 19 of the Departure Levy Act 2019; or

- Section 19 of the Tourism Tax Act 2017

Visit us www.ktp.com.my

Visit us www.thks.com.my

SME income tax Malaysia 2020

Special tax treatment for SME

A SME company/ limited liabilities partnership (LLP) is eligible to enjoy:-

Lower income tax rate

- 17% on the first RM600,000 of chargeable income.

-

100% capital allowance on small value assets

- Assets costs not exceeding RM2,000.00.

- No maximum limit of RM20,000 per year.

Criteria for SME

The followings are the criteria for a company or LLP to be regarded as SME:-

Share capital / capital contribution

At the beginning of the basis period for a year of assessment:

- A resident company: paid-up capital of RM2.5 million and less;

- LLP: Total contribution of capital of RM2.5 million and less.

AND -

Gross business income

- Gross business income not exceeding RM50 million.

- The Gross income shall be determined as follows:

a) If engaged in manufacturing, trading or services activities

- Section 22 of the Income Tax Act (ITA) 1967 – Gross income generally

- Section 24 of the ITA 1967 – Basis period to which gross income from a business is related

- Section 30 of the ITA 1967 – Special provisions applicable to cross income from a business

- Specific provisions under the ITA or specific regulations for certain industries

Practice Note No.4/2020

The Practice Note clarified the issues arising on determine the gross income from business source:

-

Investment holding company (Not listed on Bursa Malaysia) - Section 60F of ITA 1967

The entity is deemed to have no gross income from business source.

-

Investment holding company (Listed on Bursa Malaysia) - Section 60FA of ITA 1967

The entity is deemed to have gross income from business source. -

Rent or interest as other source of income

The rent or interest Is not under paragraph 4(a) of the ITA 1967, the entity is deemed to have no gross income from a business source.

-

Income from foreign business sources

Gross income from foreign business sources shall be taken into account in determining gross business income.

-

Company/LLP enjoying tax incentives - such as pioneer status or investment tax allowance

Exempted gross income from business source shall be taken into account in determining gross business income.

-

* Company/ LLP carries out a business activity.- No gross income from business sources due to current year business losses

The company/ LLP is deemed to have gross income from a business source equivalent to NIL.

- * Company/ LLP is temporary closure of business operation - No gross income from business sources due to current year business losses.

Visit us www.ktp.com.my

Visit us www.thks.com.my

Special Deduction for Renovation & Refurbishment of Business Premise

Taxpayer can claim 𝐒𝐩𝐞𝐜𝐢𝐚𝐥 𝐃𝐞𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐟𝐨𝐫 𝐑𝐞𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧 & 𝐑𝐞𝐟𝐮𝐫𝐛𝐢𝐬𝐡𝐦𝐞𝐧𝐭 𝐨𝐟 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐏𝐫𝐞𝐦𝐢𝐬𝐞 as it was finally gazetted on 28/12/20.

Keynote on the PU order:

- Gazetted on 28th December 2020

- Effective from Year Assessment 2020

- Incurred from 1st March 2020 to 31st December 2021

- Maximum amount of RM300K

- Certified by external auditor

Background story in our social media dated 30/11/20 as we voiced our concern on this special deduction.

''We, as approved tax agent, can not claim these two tax incentives namely

𝟏. 𝐒𝐩𝐞𝐜𝐢𝐚𝐥 𝐝𝐞𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐟𝐨𝐫 𝐫𝐞𝐧𝐭𝐚𝐥 𝐝𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐭𝐨 𝐒𝐌𝐄 𝐭𝐞𝐧𝐚𝐧𝐭𝐬

𝟐. 𝐃𝐞𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐟𝐨𝐫 𝐫𝐞𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐫𝐞𝐟𝐮𝐫𝐛𝐢𝐬𝐡𝐦𝐞𝐧𝐭

The above-said special tax deduction has not yet been gazetted. Claims on such incentive/deduction can only be allowed after legislation is gazetted....''

Click the gazette order PU (A) 381

INCOME TAX (COST OF RENOVATION AND REFURBISHMENT OF BUSINESS PREMISE) RULES 2020

PS #1 We still need to seek further clarification of IRB guideline especially on the involvement of external auditor on certification.

Visit us www.ktp.com.my

Visit us www.thks.com.my