Tax

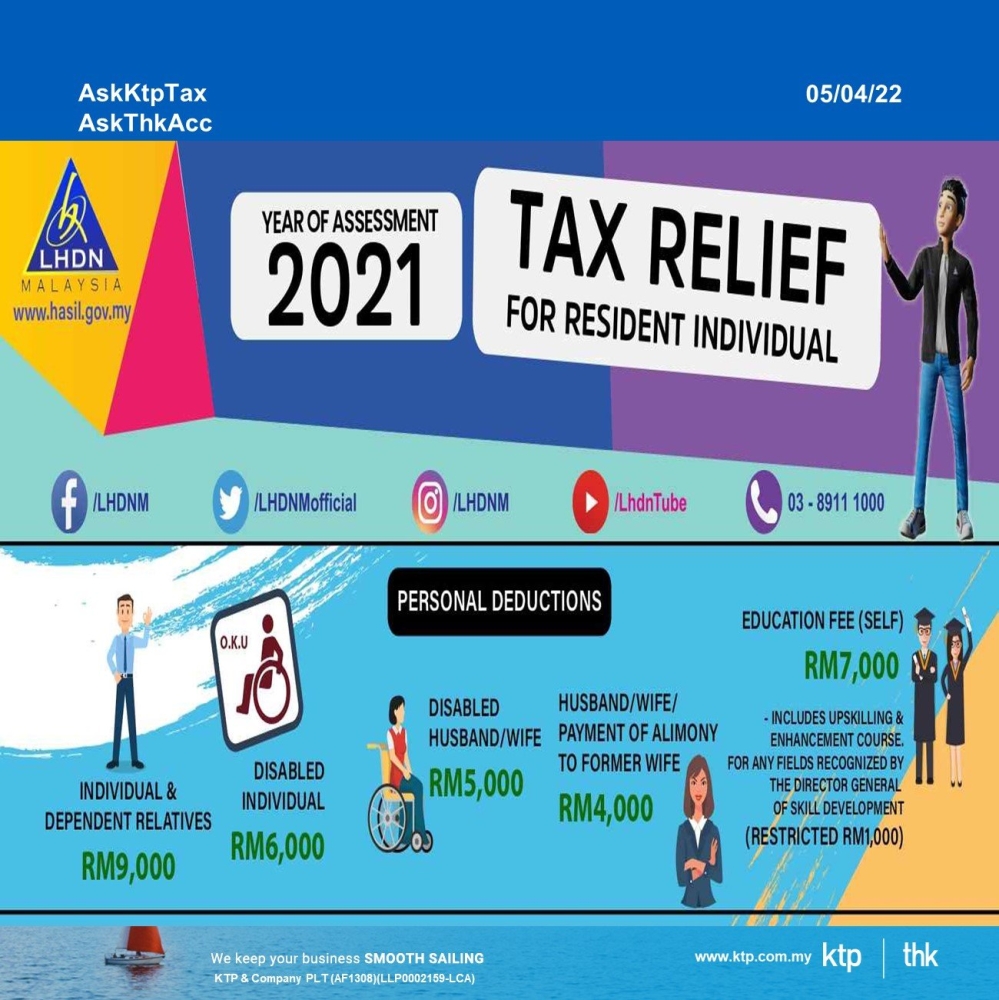

Personal Income Tax Relief 2021 Malaysia

Personal Income Tax Relief 2021 Malaysia

It is tax season whereby taxpayers are to file tax returns and pay taxes accordingly. Other than truthfully declaring your income and reliefs, and submitting your tax files before the deadline stipulated by LHDN, taxpayers are also responsible for record-keeping.

.What is the 2021 personal deduction?

With that, here’s the full list of tax reliefs for YA 2021.

1.Individual and dependent relatives - RM9,000

2. Medical treatment, special needs and carer expenses for parents (Medical condition certified by medical practitioner) - RM8,000 (Restricted)

3. Purchase of basic supporting equipment for disabled self, spouse, child or parent - RM6,000 (Restricted)

4. Disabled individual - RM6,000

5.Education fees (Self)

-

Other than a degree at masters or doctorate level - Course of study in law, accounting, islamic financing, technical, vocational, industrial, scientific or technology

-

Degree at masters or doctorate level - Any course of study

-

Any course of study undertaken for the purpose of up-skilling or self-enhancement recognized by the Director General of Skills Development under the National Skills Development Act 2006 – effective from YA 2021 until YA 2022. (Restricted to RM1,000)

RM7,000 (Restricted)

6. Medical expenses for serious diseases for self, spouse or child - RM8,000 (Restricted)

7. Medical expenses for fertility treatment for self or spouse

8. Vaccination expenses for self, spouse and child. Types of vaccines which qualify for deduction are as follows:

-

Pneumococcal;

-

Human papillomavirus (HPV);

-

Influenza;

-

Rotavirus;

-

Varicella;

-

Meningococcal;

-

TDAP combination ( tetanus-diphtheria-acellular-pertussis); and

-

Coronavirus Disease 2019 (Covid-19)

RM1,000 (Restricted)

9 (i) Complete medical examination for self, spouse, and child as defined by the Malaysian Medical Council (MMC).

(ii) COVID-19 detection test including purchase of self detection test kit for self, spouse, child.

RM1,000 (Restricted)

10. Lifestyle – Expenses for the use / benefit of self, spouse or child in respect of:

-

purchase and subscription of books / journals / magazines / newspapers (including electronic subscription) / other similar publications (Not banned reading materials)

-

purchase of personal computer, smartphone or tablet (Not for business use)

-

purchase of sports equipment for sports activity defined under the Sports Development Act 1997 and payment of gym membership

-

payment of monthly bill for internet subscription (Under own name)

RM2,500 (Restricted)

11. Lifestyle – Purchase of personal computer, smartphone or tablet for self, spouse or child and not for business use

This deduction is an addition to the deduction granted under item 10.

RM2,500 (Restricted)

12. Purchase of breastfeeding equipment for own use for a child aged 2 years and below (Deduction allowed once in every 2 years of assessment) - RM1,000 (Restricted)

13. Payment for child care fees to a registered child care centre / kindergarten for a child aged 6 years and below - RM3,000 (Restricted)

14. Net deposit in Skim Simpanan Pendidikan Nasional (Net deposit is the total deposit in 2021 MINUS total withdrawal in 2021) - RM8,000 (Restricted)

15. Husband / wife / payment of alimony to former wife- RM4,000 (Restricted)

16. Disabled husband / wife - RM5,000

17. Each unmarried child and under the age of 18 years old- RM2,000

18. Each unmarried child of 18 years and above who is receiving full-time education (''A-Level'', certificate, matriculation or preparatory courses).

RM2,000

19. Each unmarried child of 18 years and above that:

-

receiving further education in Malaysia in respect of an award of diploma or higher (excluding matriculation/ preparatory courses).

-

receiving further education outside Malaysia in respect of an award of degree or its equivalent (including Master or Doctorate).

-

the instruction and educational establishment shall be approved by the relevant government authority.

RM8,000

20. Disabled child - RM6,000

Additional exemption of RM8,000 disable child age 18 years old and above, not married and pursuing diplomas or above qualification in Malaysia @ bachelor degree or above outside Malaysia in program and in

Higher Education Institute that is accredited by related Government authorities

RM8,000

21. Life insurance and EPF INCLUDING not through salary deduction

-

Pensionable public servant category

-

Life insurance premium

-

-

OTHER than pensionable public servant category

-

Life insurance premium (Restricted to RM3,000)

-

Contribution to EPF / approved scheme (Restricted to RM4,000)

-

RM7,000 (Restricted)

22. Deferred Annuity and Private Retirement Scheme (PRS) - with effect from year assessment 2012 until year assessment 2025 - RM3,000 (Restricted)

23. Education and medical insurance (INCLUDING not through salary deduction) - RM3,000 (Restricted)

24. Contribution to the Social Security Organization (SOCSO) - RM250 (Restricted)

25. Payment for accommodation at premises registered with the Commissioner of Tourism and entrance fee to a tourist attraction

(Expenses incurred on or after 1st March 2020 until 31st December 2021)

Registered accomodation premises can be check thru link of : http://www.motac.gov.my/en/check/registered-hotel

RM1,000 (Restricted)

26. Additional lifestyle tax relief related to sports activity expended by that individual for the following:

-

Purchase of sport equipment for any sports activity as defined under the Sport Development Act 1997 (excluding motorized two-wheel bicycles);

-

Payment of rental or entrance fee to any sports facility; and

-

Payment of registration fee for any sports competition where the organizer is approved and licensed by the Commissioner of Sports under the Sport Development Act 1997.

RM500 (Restricted)

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Bad debts written off LHDN

一定要出律师信坏账才可以扣税吗?

让我们参考 IRB Public Ruling 4/2019 坏账被定义为 在采取适当措施收回后被认为无法收回的债务 :

-

发出提醒通知

-

债务重组计划.

-

债务清偿的重新安排.

-

有争议的债务的谈判或仲裁.

-

法律诉讼.

IRB Tax Ruling

Public Ruling No 4/2019 states bad debt is defined as a debt that is considered not recoverable after appropriate steps have been taken to recover it.

Public Ruling No 4/2019 described the basis of writing off a debt as bad and the actions to be taken to recover the debt as well as the evidence to prove such actions have been taken.

Reasonable steps have been taken to recover the trade debt:

-

Issuing reminder notices

-

Debt restructuring scheme

-

Rescheduling of debt settlement

-

Negotiation or arbitration of a disputed debt

-

Legal action

KTP/THK key takeaways

不必要出律师信....坏账才可以扣税吗?

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Are gifts from employer taxable in Malaysia?

Are gifts from employer taxable in Malaysia?

Common questions on gifts from our clients?

1. Cash is given to an employee by the employer for passing the professional examination with excellent results? Taxable?

2. Wedding gifts whether, in the form of cash, jewelry or other items were given to an employee by the employer? Taxable?

3. Gift or reward from my employer during the New Year celebration? Taxable?

Overview

In a competitive business climate, a gift or reward has been proven to improve organizational values, enhance team efforts, increase customer satisfaction and motivate certain behaviors amongst members of staff.

However, do you know the tax impact of the gift or reward received?

Key takeaway

You will understand the:

• Meaning of perquisites

• Tax treatment of perquisites

What are Perquisites?

Perquisites are benefits in cash or in-kind which are convertible into money received by an employee from his/her employer or from third parties in respect of having or exercising employment.

Perquisite is a chargeable income to tax as part of the gross income from employment under paragraph 13(1)(a) of the ITA.

Tax treatment

1. In respect of having employment or exercising an employment

a) Gift

The value of the gift is chargeable to tax when it is received, can be sold, assigned, or convertible into cash, and is received in appreciation for the performance of past services.

However, there is an exemption of RM2,000 under paragraph 25C, Schedule 6 of the ITA if is for a long service award.

b) A sum of cash

Cash money is considered a perquisite if it is an appreciation for the excellent service rendered even though it is given voluntarily by the employer.

* The phrase having employment or exercising employment includes the performance or any duties by an employee.

2. Not related to having or exercising the employment

Pure gifts or testimonials received by an employee from his employer or third parties purely for personal appreciation or for specific personal reasons are not taxable.

Examples of pure gifts or testimonials include:

a) wedding gifts whether, in the form of cash, jewelry or other items were given to an employee by the employer.

b) cash is given to an employee by the employer for passing the professional examination with excellent results.

c) cash, other items and certificate of appreciation given to an employee for his/her extraordinary achievement.

Source:

Perquisites from Employment (PR 5/2019)

http://lampiran1.hasil.gov.my/pdf/pdfam/PR_05_2019.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Bookkeeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, bookkeeping and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

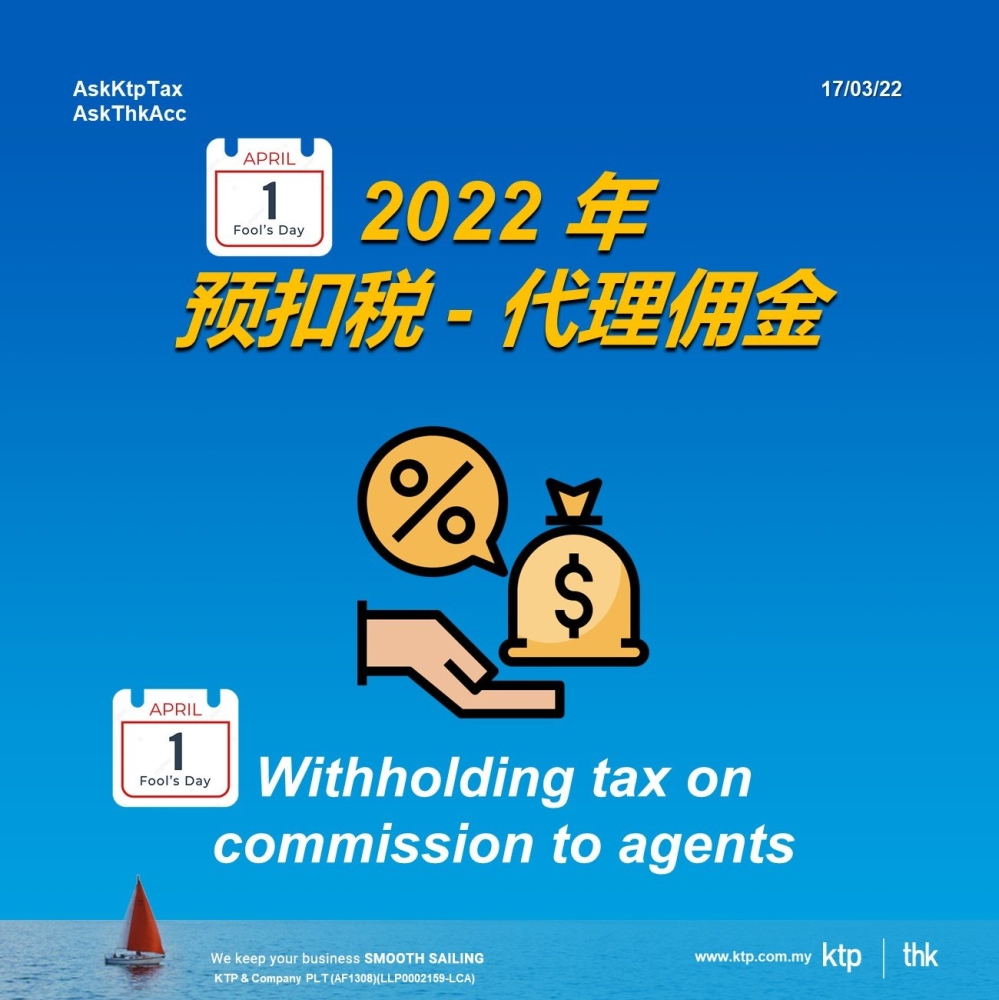

Withholding Tax on Payments to Agents

Withholding Tax on Payments to Agents

With effect from Jan. 1, 2022, a 2% withholding tax (WHT) will be imposed on monetary payments made by companies to their authorized agents, dealers or distributors, arising from sales, transactions or schemes carried out by the Agents.

A new Section 107D of the Income Tax Act 1967 (ITA) was introduced under the Finance Bill 2021 following the Budget 2022 announcement on 29 October 2021.

The WHT is applicable on in-scope payments made to resident agents, dealers or distributors who are individual residents and who have received more than RM100,000 of such payments in monetary form and/or non-monetary form from the same company in the immediately preceding year of assessment (YA)

The tax withheld is to be remitted to the lRBM within 30 days from date of payment or crediting the payment to the agent, dealer or distributor.

Companies which fail to comply with this requirement will be subject to an increase in tax equivalent to 10% of the outstanding WHT and the underlying gross expenses which are subject to the WHT would be denied a tax deduction

Deferment of remittance of withholding tax

To ensure that all companies which are liable to make payment are able to make appropriate preparations and notifications to their agents, dealers and distributors, that payer companies are allowed to defer the ''remittance'' of the WHT until 31 March 2022 where payer companies are allowed to remit the WHT related to payments for the months of January until March 2022 from 1 April 2022 without being subject to any increase in tax.

Key salient points from the IRBM FAQ:-

• The WHT is not applicable on payment by way of credit note, contra-transaction and discount given to an agent, dealer or distributor.

• The payer company is required to apply the WHT even though the agent, dealer or distributor is subject to CP500 tax instalment payment.

• The category of individual includes sole proprietor and individual partner in a partnership. However, it excludes payment made to a partnership or a Limited Liability Partnership.

• The threshold amount of RM100,000 in the preceding year is to be determined each year. In determining the applicability of section 107D, the residency status of the agents, dealer or distributor in the immediate preceding year is irrelevant

• The preceding year RM100,000 threshold value is to be tested each year (not on a one-off basis) in order to determine whether withholding tax will apply for payment made in the current year.

• The agent, dealer or distributor must have an income tax reference number.

• The 2% WHT amount is to be reported in Form CP58.

• The 2% WHT will be considered as part of the payment for the balance of tax to be paid, upon submission of the income tax return form for the relevant YA by the agent, dealer or distributor.

• The WHT shall be remitted to the IRBM within 30 days after paying or crediting such payments to the agent, dealer or distributor. Remittance is to be made together with Form CP107D.

• If there is a failure to make the WHT payment to the IRBM within the stipulated time, a penalty of 10% would be imposed on the unpaid withholding tax. In addition, the tax deduction for the gross amount of the payment made to agent, dealer or distributor will be disallowed.

• Where a company is making payments to several agents, the company may complete the details of payment for each agents in the appendix [Lampiran CP107D(1)], which is to be attached together with the WHT remittance form [CP107D]. Each appendix could cater up to 20 recipients.

• The amended Form CP58 will include section to report the WHT deducted.

• The WHT remittance form and appendix as well as the updated Form CP58 have yet been released by the IRBM.

• The WHT can be made at the IRBM Service/Payment Counters.

Source

IRBM has issued a Frequently Asked Questions (FAQ) dated 28 February 2022 (only available in Bahasa Malaysia) on the application of the above Section 107D.

https://phl.hasil.gov.my/pdf/pdfam/Soalan_Lazim_Seksyen_107D_ACP_1967.pdf

Reference :

Read our past posting on withholding tax on payment to agents in our blog

1. 2% withholding tax on commission dated on 30.12.2021

https://bit.ly/3hRrk20

2. 预算案 2022 dated 19.11.2021

https://bit.ly/3tKU7dM

3. Budget 2022 - SME edition dated on 18.11.2021

https://bit.ly/3IWhAiR

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Bookkeeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource bookkeeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

马来西亚对海外收入征税政策

马来西亚对海外收入征税政策...

真的是

一场游戏一场梦

不要谈什么分离 我不会因为这样而哭泣

那只是昨夜的一场梦而已

不要说愿不愿意 我不会因为这样而在意

那只是昨夜的一场游戏

雪消春水一场空....白费我们之前所做的

1. Foreign source income taxable in Malaysia 2022 dated on 11/01/2022

https://bit.ly/3KL1NUx

2. (u-turn update) foreign source income budget 2022 dated on 31/12/2021

https://bit.ly/3tXbici

3. FAQ on Special Income Remittance Programme (PKPP) dated on 27/12/2021

https://bit.ly/3CFoNBq

4. Special Income Remittance Programme (PKPP) to Malaysian Residents dated on 8/12/2021

https://bit.ly/35ObF0Z

5. 预算案 2022 dated on 19/11/2021

https://bit.ly/3tYpdPz

6. Budget 2022 - SME edition dated on 18/11/2021

https://bit.ly/3tRcq1i

7. Foreign source income taxable in Malaysia dated on 10/11/2021

https://bit.ly/3w5BG6y

8. Foreign Income Remitted Into Malaysia Taxable 2022 on 2/11/2021

https://bit.ly/3tTfJVI

9. 海外收入汇回大马时将被征税 dated on 2/11/2021

https://bit.ly/3Imb8k9

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Bookkeeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource bookkeeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Maximizing Tax Benefits on Capital Expenditure

Maximizing Tax Benefits on Capital Expenditure

Company may maximize their tax benefits on the capital expenditure. Below are actions, you may take in order to help you with tax saving.

No worries, we explain to you how to maximize your tax benefits by using some real-life cases.

Capital Allowance

Generally, capital allowance is eligible for plant and machinery, or tools and equipment for business.

What are tools and equipment?

Some examples of the case law to enhance our understanding.

KPHDN v Tropiland Sdn Bhd (2012) (Court of Appeal)

• The argument here is whether the 7-storey car park is a tool and equipment to the business?

• The taxpayer is a property developer and constructed a multi-story car park before letting it out. They claim a capital allowance for the car park.

• The taxpayer’s income was derived from the rental of the car park. Without the multi-story car park, the taxpayer could not have generated an income from the land.

Hence, they can claim the capital allowance for the car park.

Industrial Building Allowance(IBA)

If you own or rent a factory for your business, you may claim the qualifying expenditures under Industrial Building Allowance (IBA).

Reinvestment Allowance(RA)

The definition given by MIDA, RA is available for existing companies engaged in manufacturing and selected agricultural activities that reinvest for expansion, automation, modernization, or diversification into any related products within the same industry on condition.

Lavender Confectionery & Bakery Sdn Bhd V KPHDN

Lavender is a manufacturer, distributor and dealer in cakes, confectionery, bread and biscuits.

In YA 2011, the company claimed Industrial Building Allowance (IBA) for the additional demolition of substructures and renovation and Reinvestment Allowance (RA) for plant and machinery for JB factory and KL Outlet.

However, it had been rejected due to one of the demolition cost before constructing the buildings which did not form part of the Lavender’s factory. Company is also disallowed to claim under RA due to the items are not used in the factory.

For IBA claim of the Company, the decision of the Court is the Company can claim for the IBA since they fulfilled the IBA claim requirement of building used for purpose of business and used as a factory.

The Company can claim for RA as they fulfilled the RA claim requirement as

• The Company must be a resident of Malaysia

• An operation for more than 36 months

• Incurred capital expenditures are for the expansion of their business.

As their outlet in KL continues the manufacturing process of bread and confectionaries in the principal factory at Plentong.

The capital expenditures incurred for plant and machinery that leads to the expansion of Company’ business is entitled to RA.

What does KTP say?

From the story above, we can understand that the determining factor between Capital allowance and Industrial building allowance is whether it is a “tool” to generate income or it is a ''building'' that is used as industrial business purposes.

Qualified expenditure can be the assets themselves and also the incidental cost incurred on the assets. To maximize your claim, we can always go back to the ruling or act to look at the definition.

Sources

KPHDN v Tropiland Sdn Bhd (2012) (Court of Appeal)

https://bit.ly/3MIlDBq

Lavender Confectionery & Bakery Sdn Bhd V KPHDN

https://bit.ly/35RDSnn

Qualifying Expenditure and Computation of Industrial Building Allowances

https://bit.ly/379lK8P

Qualifying Expenditure And Computation Of Capital Allowances

https://bit.ly/366wQek

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Book-keeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource book-keeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Book-keeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource book-keeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

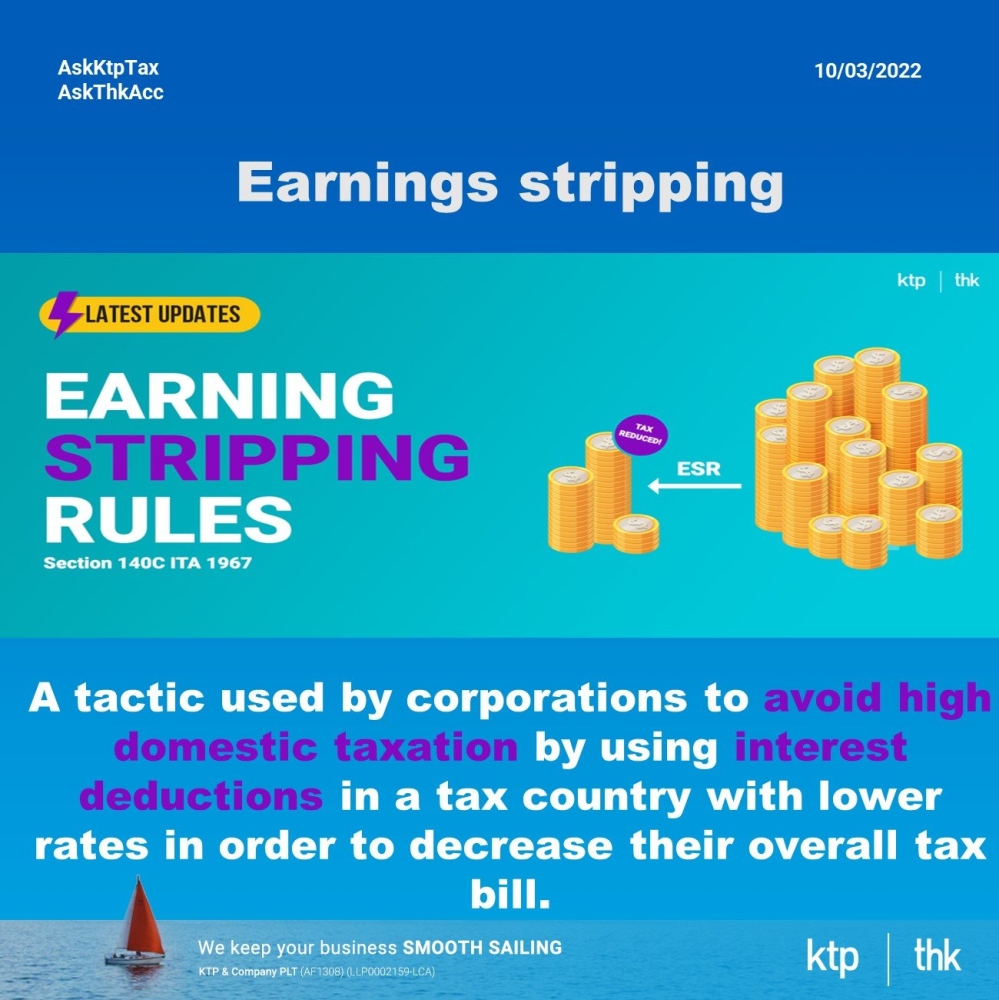

earning stripping rules malaysia lhdn

Update on Earning Stripping Rule (ESR)

The Income Tax (Restriction on Deductibility of Interest) (Amendment) Rules 2022 (“Amendment Rules”) has been gazetted to amend the Income Tax (Restriction on Deductibility of Interest) Rules 2019.

The following two Principal Rules is amended in amendment rules:

1. Definition of qualifying deduction

2. Carrying forward of excess interest

The amendment rules came into operation on 1 February 2022.

Key takeaways:

You will understand: -

1. What is ESR?

2. Scope of application

3. New amendment on Principal Rules

4. Non-application

Summary of learnings:

1. What is ESR?

Effective from 01 July 2019, ESR was introduced under Section 140C of the Income Tax Act 1967 (ITA) to restrict the tax deduction on interest expenses in relation to financial assistance in a controlled transaction.

Under the ESR, the maximum amount of interest that can be deducted is 20% of the tax – EBITDA (earnings before interest, tax, depreciation, and amortization).

*Tax – EBITDA = Adjusted Business Income + Qualifying deduction+ Total Interest Expenses claimed in business Income.

2. Scope of application

ESR apply to interest expenses that arise from financial assistance granted by:

- its associated person outside Malaysia;

- its associated person outside Malaysia which operates through a permanent establishment in Malaysia;

- a third party outside Malaysia where the financial assistance is guaranteed by its holding company or any other enterprises under the same MNE Group

Financial assistance includes loans, interest-bearing trade credit, advance, debt, or the provision of security or guarantee.

3. New amendment on Principal Rules

The amendments are as outlined below:

i. Definition of qualifying deduction

Qualifying deduction is equal to the total incentive claims (special deduction, further deduction, double deduction, etc.) deducted in arriving at adjusted income. The definition is replaced as follows:

- where there is business expenditure incurred in the profit and loss account is allowed as deduction under the Act and the amount of the deduction allowed exceeds the amount of the business expenditure incurred, an amount equal to the difference between the amount of the deduction allowed and the amount of the business expenditure incurred in the profit and loss account; or

- where there is no business expenditure incurred in the profit and loss account, the amount of deduction is allowable under the Act.

ii. Carry forward rules

- The carry forward rules allow the restricted interest expenses in a year of assessment (YA) to be carried forward and to be deducted against the company’s adjusted income for the subsequent YAs.

- This rule now applies to any person and is not limited to a company.

4. Non-application

According to the De minimis threshold, ESR is not applicable where the total interest expenses for all financial assistance is equal to or less than RM500,000 in a YA.

Source:

Income Tax (Restriction on Deductibility of Interest) (Amendment) Rules 2022:

https://phl.hasil.gov.my/pdf/pdfam/ESR_Rules_Pindaan_2022.pdf

Restriction on the deductibility of interest guidelines:

http://lampiran1.hasil.gov.my/pdf/pdfam/RDIG_05072019.pdf

This message was brought to you by KTP

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Book-keeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource book-keeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Form E 常见错误

Form E 常见错误

回顾我们过去在 2021 年 16 月 3 日为 KTP|THK 客户举办的免费网络研讨会,由 Ms Caroline Lim 主持 as speaker.

https://youtu.be/84szaL-0Tok

阅读我们过去在 Form E 上的社交媒体帖子

Part 2 Form EA - Benefit in kind and perquisites

1) 董事医疗费 是 免税 (tax free) ??? 实物受益(benefit in Kind) ??? dated 19/02/2021

2) 1分钟学习“如何在BIK / Perquisites计算PCB” dated on 17/02/2021

3) 只要你点进来,你能看到员工薪酬-税务节省大秘密 BIK 章 Part I dated 10/02/2021

4) 只要你点进来,你能看到员工薪酬-税务节省大秘密 Part II dated 08/02/2021

5) 注意!你是否有正确的计算与提交预扣税(PCB)。dated on 26/01/2021

This message was brought to you by KTP

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Book-keeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource book-keeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

E呈报(E Filing)Form E

E呈报(E Filing)Form E

Read our full story in our bloghttps://www.ktp.com.my/blog/efiling-forme-2021/08mar2022

阅读我们过去在 Facebook 上的 E/EA 表格上的分享 :

1) Tax Filing Deadline 2022 Malaysia dated on 10/01/2022

2) E呈报(E Filing)Form E 终极秘籍 dated on 15/03/2021

3) 温馨提示 - Form E 截至日期为31/03/2021 dated on 12/03/2021

4) Form EA 有什么? Dated on 22/02/2021

5) 花红几时需要报进Form EA? Dated on 16/02/2021

6) 公司给员工红包可不可以扣税? Dated on 10/02/2021

7) Deadline for Form E submission is approaching! dated on 09/02/2021

8) 是时候呈报𝐅𝐨𝐫𝐦 𝐄了,让我们为您复习一遍!dated on 28/01/2021 各位雇主与员工请注意!!!

9) 你知不知道 ... IRB不再打印+发E表格(Form E) 给雇主! Dated on 25/01/2021

Reinvestment Allowance LHDN

Common mistakes in claiming reinvestment allowance

Reinvestment Allowance is a red flag to IRBM so Reinvestment Allowance is always scrutinized by our IRBM during tax audit/investigation.

What is reinvestment allowance?

Reinvestment allowance (RA), as the name suggests, is an incentive to encourage companies to reinvest and expand their businesses. It is only granted after the company has been in business for a certain period of time, and only to companies resident in Malaysia.

How good is reinvestment allowance?

The allowance is given for 15 years from the first year of claim. The allowance is computed at 60% of QCE incurred and can be utilised against 70% of statutory income

Latest development in reinvestment allowance

Budget 2021 has announced that a special Reinvestment Allowance (RA) will be given for eligible manufacturing and agricultural projects in Years of assessment (YA) 2020 to YA 2022.

This means that eligible companies that have fully utilized their 15-years RA can enjoy additional RA claims for 3 years (YA2020 to YA2022).

Common mistakes in claiming reinvestment allowance

-

The purchase invoice is the only supporting document available. The absence of a project paper, feasibility study, business plans, budgets, directors resolutions, and other relevant documents supporting the project;

-

Mismatch between the company incurring the investments and the company using the plant and machinery;

-

Claim RA on assets incurred for the benefits of related companies/directors.

-

Claim RA on non-qualifying activities.

-

Claim RA on the transfer of assets from related parties who have previously claimed RA on the same assets.

-

The absence of payment records to support the qualified assets.

-

Supporting documents are not kept for at least 7 years.

-

Clain RA concurrently with other tax incentives (like PS, ITA & etc).

-

No written/ pictorial production flow on the qualifying project

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Form E 2021 LHDN

Top 7 questions on Form E 2021

Overview

From 01 March 2022, the employer must submit Form E for the Year 2021 and the submission can be done through LHDNM electronic filing system.

Let's mark the date so that we will not miss the deadline.

Key takeaways:

You will understand the responsibility and consequences as follows: --

1. What is Form E?

2. Who is the employer?

3. Who is compulsory to furnish Form E?

4. Who is exempted for the C.P.8D?

5. What is the information to be included in Form E?

6. What is the deadline for Form E & EA?

7. What is the consequence fail to submit Form E?

Summary of learning

1. What is Form E?

- Form E is a declaration report to be submitted by every employer to LHDNM every year not later than 31 March.

2. Who is the employer?

- The employer has included Company, Limited Liability Partnership, Partnership, Enterprise and etc.

3. Who is compulsory to furnish Form E?

- All employer (active and dormant companies) whether it has an employee or do not have any employees.

4. Who is exempted for submitted C.P.8D?

- Sole proprietorship, partnership, Hindu joint family and deceased person’s estate who do not have employees are exempted for the submission.

5. What is the information to be included in Form E?

There are 4 parts in Form E.

(a) Basic information

- Name of the employer as registered under SSM

- Employer’s E number

- Status of the employer

- correspondence with LHDNM and etc

(b) Information on a number of employees for the year ended 31 December 2021

- Number of employees as of 31/12/2021 included for those subject to Monthly Tax Deduction, new employees or ceased employment or died.

- Employees include full time/part-time/contract employees and interns.

(c) Declaration

- Declared by the employer.

(d) C.P.8D Return of Remuneration from the Employment, claim for deduction, and particulars of tax deduction under the Income Tax Rules (Deduction from Remuneration) 1994 for the Year Ended 31 December 2021

- Employers are required to complete all particulars of employees in C.P.8D.

6. What is the deadline for Form E & EA?

- Form EA: provide to employees not later than 28 February 2022

- Form E: submit to LHDNM not later than 31 March 2022

7. What is the consequence fail to submit Form E?

- The employer is liable to a fine of RM200 - RM20,000 or imprisonment for a term not exceeding six months of both.

Sources

Return Form of Employer (Remuneration for the Year 2021)

https://phl.hasil.gov.my/pdf/pdfam/ExplanatoryNotes_E2021_2.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Special Tax Deduction Flexible Working Arrangement

Special Tax Deduction Flexible Working Arrangement

The Flexible Work Arrangement (FWA) Income Tax Deduction is an initiative by our Malaysian government to support eligible employers who implement or enhance FWA for their company.

Scope of Expenses on Tax Incentive on FWA

A double deduction is given for the following expenses:

(a) Consultation fees

(b) Cost of capacity development

(a) Training courses or programme fees

(b) Internal trainer fees

(c) Cost of training materials

(d) Rental of training space

(e) Examination fees, and

(f) Training-related travelling expenses incurred by the trainers and employees as follows:

i. Transportation:

a. Travels from Malaysia to outside Malaysia, and vice versa

- Amount equal to economic class air fare

b. Travels within Malaysia

- Air transport: Amount equal to economic class air fare

- Land or water transfer: Actual cost

ii. Accommodation: Capped at RM300 per day

iii. Meals: Capped at RM150 per day

(c) Cost of software

(d) Software subscriptions

Tax Incentives on FWA

The deduction is given for a period of three consecutive YAs, commencing from the YA in which the certification of the implementation of FWA is given by TalentCorp.

The Income Tax (Deduction for the Cost of Implementation of Flexible Work Arrangements) Rules 2021 [P.U.(A) 377] were gazetted on 4 October 2021.

The Rules are deemed to be effective from YA 2020.

Qualified Company

A Malaysian-resident, which is a:

(a) Company incorporated under the Companies Act 2016

(b) Limited liability partnership registered under the Limited Liability Partnerships Act 2012, or

(c) Partnership registered under the Partnership Act 1961

How to apply?

1. Read the Guidelines and FAQ for the eligibility and criteria.

2. Fill in the Application Form and the Declaration Form

3. Submit the application via email flexworklife@talentcorp.com.my

4. Successful application will receive the Surat Pengesahan Pengaturan Kerja Flekisble, for your e-filing with LHDN.

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Can LHDN access your bank account?

Under what circumstance your bank information is accessible by LHDN?

The new provision does not give it absolute power to simply access taxpayers' bank account information.

It is only limited to cases involving garnishee orders allowed by the Court.

LHDN is required to go through a prescribed process of judgment and is only limited to cases that have already gone through a civil proceeding before.

What is garnishee order?

The garnishee proceedings are the process of enforcing a monetary judgment by seizing or withholding debts due to a specific party.

LHDN has the right to do so because of the existence of unpaid tax arrears by the taxpayer.

Source:

https://phl.hasil.gov.my/pdf/pdfam/KM_HASiL_18122021_HAD_AKSES_AKAUN_BANK.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Deduction for Expenditure on Provision of Employees’ Accommodation

Deduction for Expenditure on Provision of Employees’ Accommodation

Overview:

Are you planning to let your employees back to the workplace but are too afraid of the number of COVID cases reported every day? You may consider Safe@Work introduced by the Ministry of International Trade and Industry (MITI). This allows business continuity even when there are positive cases in the work place.

On 24 December 2021, the Government announce a further tax deduction on rental expenses provided for employees to promote Safe@Work program.

Key takeaways:

1) Who can apply?

2) How to apply?

Summary of learnings:

The company is allowed to deduct an amount equivalent to the expenses incurred on rental of a premise for the purpose of employees’ accommodation within the period from 1 January 2021 until 31 December 2022, subject to a maximum amount of RM50,000 for each company. The company must obtain Certificate from Ministry of International Trade and Industry to enjoy this deduction.

1. Who can apply

A company which: -

- Incorporated under Company Act 2016;

- carrying on the business of manufacturing or manufacturing related services; and

- Incurred rental for the purpose of employees’ accommodation.

2. How to apply?

Step 1 : To comply with Safe@Work SOPs

Step 2 : To comply with the Minimum standards of accommodation set by MoHR

Step 3 : Obtain the certificate in CIMS system

Sources & Relevant Links:

• P.U. (A) 470 – Deduction for expenditure on provision of employees’ accommodation

https://lom.agc.gov.my/ilims/upload/portal/akta/outputp/1718705/PUA%20470.pdf

• Information Related to Safe@Work:

https://www.miti.gov.my/redir/safeatwork/safeatwork.html

• Minimum standards of accommodation

https://jtksm.mohr.gov.my/images/akta446/1_panduan_pemohon_v2.pdf

• Registration or login to CIMS

https://notification.miti.gov.my/login

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

tax rebate 20,000 malaysia

Tax rebate for new incorporated company LHDN

Income Tax (Conditions for the Grant of Rebate under Subsection 6D(4) Order 2021 @ 31/12/21

This order has effect from the year of assessment 2021.

Conditions for the grant of rebate

-

Own by the company with paid-up share capital not more than RM2.5 million.

-

Different premises from its related company.

-

Shall not use the plant, equipment & facility of the related company.

-

Employee (except CEO & director) is different from related company.

-

Business is different from related company.

-

Business is different from sole proprietorship.

-

Not M&A with paid up share capital more than RM2.5m or revenue RM50m.

Other pertaining key information

Related company refer as more than 50% of paid up share capital.

A rebate may be granted for YA 2021 and 2022 on company commence business operation after 1/7/2020 with basis period ended 31/12/2020.

Source :

PU Order 504_2021 Income Tax (Conditions for the grant of rebate under subsection 6D(4) order 2021 on 31.12.2021.

https://lom.agc.gov.my/.../outputp/1719408/PUA504_2021.pdf

Update on our past blog on tax rebate

a. 有限公司或有限合伙企业的回扣 (RM20,000 x 3 years) – Post on 19.11.2020

https://www.ktp.com.my/blog/ns9lfg2j36acs7w-bphe6-pbtm3-k6mng-gzk5f-taxrebateenglish-bg3t3

b. 𝐓𝐚𝐱 𝐑𝐞𝐛𝐚𝐭𝐞 (𝐑𝐌𝟐𝟎,𝟎𝟎𝟎 𝐱 𝟑 𝐲𝐞𝐚𝐫𝐬) 𝐨𝐧 𝐟𝐨𝐫 𝐜𝐨𝐦𝐩𝐚𝐧𝐲 𝐨𝐫 𝐥𝐢𝐦𝐢𝐭𝐞𝐝 𝐥𝐢𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐩𝐚𝐫𝐭𝐧𝐞𝐫𝐬𝐡𝐢𝐩. – Post on 19.11.2020

https://www.ktp.com.my/blog/ns9lfg2j36acs7w-bphe6-pbtm3-k6mng-gzk5f-taxrebateenglish

c. The advantages of buying property via Sdn Bhd? Posting on 16 April 2021

https://www.ktp.com.my/blog/buy-property-via-sdn-bhd/16april2021

d. The disadvantages of buying property via Sdn Bhd (Copy) Part 2 Posting on 19 April 2021

https://www.ktp.com.my/blog/buy-property-via-sdn-bhd-part2/19april2021

e. Investment holding company enjoy tax rebate RM20,000 x 3 years ? Part 3 Posting on 20 April 2021

https://www.ktp.com.my/blog/buy-property-via-sdn-bhd-part3/20april2021-hgpza

f. Can unlisted investment holding company (IHC) enjoy tax rebate RM20,000 x 3 years? Part 4 Posting on 21 April 2021

https://www.ktp.com.my/blog/buy-property-via-sdn-bhd-part4/21april2021

g. 预算案 2022 Posting on 19 November 2021

https://www.ktp.com.my/blog/tax-budget-2022-sme-edition-chinese/19nov21?rq=20%2C000

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Medical Fee on Director -Tax exempted Benefit In Kind?

Medical Fee on Director -Tax exempted Benefit In Kind?

FAQ from our clients on this common mistake by taxpayers based on our past experience :

-

Why are company’s directors not human meh?

-

Why is my ex ''tax agent'' allow?

-

Why is the Malaysian government like this?

Tax standing

Under section 13(1) b Income Tax 1967, medical and dental benefits are exempted from income tax for the employee.

Exception

Does the exemption extend to directors of a controlled company like for any other employees of the company?

Under paragraph 8.3.1 of IRB Public Ruling No. 11/2019- Benefits In Kinds., if the employee receiving BIK from the employer has control over his employer (company) is no exemption.

What is control?

For a company, the power of an employee to control is through :

1. The holding of shares or

2. The possession of voting power in or

3. By virtue of powers conferred by the articles of association or other document.

For a partnership, the employee is a partner of the employer.

For a sole proprietor, the employee and the employer is the same person

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Are gifts to employees considered income?

Is gift from employer taxable?

When I received a gift or reward from my employer during the New Year celebration, will this affect my tax payable?

Overview

In a competitive business climate, a gift or reward has been proven to improve organizational values, enhance team efforts, increase customer satisfaction and motivate certain behaviours amongst members of staff.

However, do you know the tax impact of the gift or reward received?

Key takeaway

You will understand the:

-

Meaning of perquisites

-

Tax treatment of perquisites

What are Perquisites?

Perquisites are benefits in cash or in-kind which are convertible into money received by an employee from his/her employer or from third parties in respect of having or exercising employment.

Perquisite is a chargeable income to tax as part of the gross income from employment under paragraph 13(1)(a) of the ITA.

Tax treatment

1. In respect of having employment or exercising an employment

a) Gift

The value of the gift is chargeable to tax when it is received, can be sold, assigned, or convertible into cash, and is received in appreciation for the performance of past services.

However, there is an exemption of RM2,000 under paragraph 25C, Schedule 6 of the ITA if is for a long service award.

b) A sum of cash

Cash money is considered a perquisite if it is an appreciation for the excellent service rendered even though it is given voluntarily by the employer.

* The phrase having employment or exercising employment includes the performance or any duties by an employee.

2. Not related to having or exercising the employment

Pure gifts or testimonials received by an employee from his employer or third parties purely for personal appreciation or for specific personal reasons are not taxable.

Examples of pure gifts or testimonials include:

a) wedding gifts whether, in the form of cash, jewellery or other items were given to an employee by the employer.

b) cash is given to an employee by the employer for passing the professional examination with excellent results.

c) cash, other items and certificate of appreciation given to an employee for his/her extraordinary achievement.

Source:

Public Ruling 5/2019 Perquisites from Employment

http://lampiran1.hasil.gov.my/pdf/pdfam/PR_05_2019.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

What is tax exempted allowance in Malaysia?

Which allowances and perquisites are totally exempted?

Common tax questions from clients :

1. What income is not taxable in Malaysia?

2. Any tax exempted benefits in kind to employees in Malaysia?

3. Which allowances and perquisites are totally exempted?

Employment Income

Statutory income from employment refers to not only your monthly salary, but also any commission, bonus, allowances, perquisites, benefits-in-kind, and even accommodation.

Exempted Employment Income

Of course, there are certain types of income within this list that does not have to be included in your income for tax purposes – in other words, income that is exempted from tax. If you are given a tax exemption up to a certain value, you don’t have to include that amount in your declaration of income.

Exempted Benefit-in-kind / perquisite

Petrol, travel, toll allowances

Up to RM6,000. If the amount exceeds RM6,000, further deductions can be made in respect of the amount spent for official duties.

Parking allowance, including parking rate paid by the employer directly

Actual amount expended

Meal allowance received on a regular basis

Actual amount expended

Medical benefits (including traditional medicine and maternity expenses) Actual amount expended

Child care allowance for children up to 12 years old

Up to RM2,400.

Benefit, whether in money or otherwise, for past achievements, service excellence, or long service award, etc

Up to RM2,000.

Gift of fixed-line telephone, mobile phone, etc registered in employee’s name

Limited to 1 unit for each asset

Monthly bills for phone or broadband line registered in employee’s name Limited to 1 line for each category of asset

Company goods provided free or at a discount to the employee, spouse, or unmarried children

Up to RM1,000

Subsidised interest for housing, education, or car loan

Fully exempted if total loan amount does not exceed RM300,000. For exceeding amounts, there is a calculation formula that you can find in the explanatory notes to the BE form.

Leave passage (vacation time paid for by employer)

Exempted up to 3x in a year for leave passage within Malaysia (fares, meals, accommodation) and 1x outside Malaysia (up to RM3,000 for fares only)

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Can I buy a Personal car under a Company and Claim Tax Deduction?

Buy Car under Personal or Company Name?

What is capital allowance

The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business.

Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for the purposes of business.

Eligibility of capital allowance

1. Owner of the car;

2. Capital expenditure incurred on the car;

3. The car is in use at the end of basis period;

4. Used for the purpose of the business

WHO is eligible for capital allowance

Legal owner: Entity registered or documented as proof of ownership

Beneficial owner: Entity who incurred the expenditure and payment for the assets (can be proved in books of accounts through supporting documents)

A legal owner who incurs the qualifying expenditure is also the beneficial owner.

If the asset owned is used in his business, the owner is entitled to claim CA.

If a beneficial owner has:

1. Incurred the qualifying expenditure

2. Used the asset for his business,

He is entitled to claim CA although the asset is registered in the name of another person (the legal owner).

Jointly owned assets

What if…

a) more than one person has incurred the qualifying expenditure on an asset,

b) the asset is used in each of their business during the basis period,

c) the asset is registered in the name of one of the beneficial owners or in the name of the third party

WHO is eligible for capital allowance under jointly owned assets

Each of the beneficial owners is entitled to claim CA in respect of the asset.

Basis of apportionment of the CA should be based on his share of qualifying expenditure incurred

Supporting documents

Details of apportionment must be made if more than one person is claiming CA for the same asset.

Source:

IRB Public Ruling

OWNERSHIP AND USE OF ASSET FOR THE PURPOSE OF CLAIMING CAPITAL ALLOWANCES

https://phl.hasil.gov.my/pdf/pdfam/PR_5_2014.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Form EA 和 CP58 有什么不同?

Form EA 和 CP58 有什么不同

Form EA

它是一份员工的年度薪酬报表, 报表中 列出员工过去一年的收入福利,每月预扣税(PCB),公积金等等。

CP58

它是一份收入列表将列出支付给代理商,经销商或分销商的现金和非现金奖励。

Form EA 呈报种类

• 工资,薪水,休假工资,佣金,奖金,酬金,花红,董事费,津贴

• 公司汽车,汽油津贴,水电费津贴,电话费津贴,家佣

• 住宿福利

• 失业补偿金

• 退休金

CP58 呈报种类

• 现金奖励:佣金,奖励金,花红

• 非现金奖励: 汽车,房屋,旅行配

套,代金券

Form EA 截止日期

每年2月的最后一天之前须分发给员工

CP58 截止日期

每年3月31日之前须分发给代理商,经销商或分销商

* Form EA 和 CP58 不必呈交给税务局

Form EA 和 CP58 罚款

Form EA 和 CP58 罚款一致,如果没有呈报,将会有RM200至RM20,000的罚款或不超过6个月的监禁,或两者兼施

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks