Blog

Applicability Of Section 140 Of The ITA 1967 on Transfer Pricing Adjustment

Applicability Of Section 140 Of The ITA 1967 on Transfer Pricing Adjustment

SECTION 140 – POWER TO DISREGARD CERTAIN TRANSACTIONS

Section 140 of the Act provides wide and general powers to the Director

General of the Inland Revenue (DGIR) to combat tax avoidance by disregarding certain transactions and computing or re-computing tax liability of a taxpayer.

Where the DGIR has reason to believe that any transaction produces the effect

of:

• altering the incidence of tax

• relieving from a tax liability

• evading or avoiding tax, or

• hindering or preventing the operation of the Act

he may disregard or vary such a transaction to counteract its intended effect.

In particular, DGIR may invoke Section 140 in respect of transactions between:

• related parties – ie persons, one of whom has control over the other or both are under common control, or

• individuals who are relatives (parent, child, sibling, uncle, aunt, nephew,

niece, cousin, grandparent, grandchild)

on the grounds that such transactions are not on par with transactions

between independent parties dealing at arm’s length.

Transfer pricing adjustment

Whilst the Revenue is empowered to counteract any tax avoidance scheme via Section 140(1) of the ITA, this provision does not extend to transfer pricing adjustments.

We examine a recent decision by the Special Commissioner of Income Tax in OMSB v KPHDN where the Revenue’s transfer pricing adjustments were set aside.

RDS analysis on OMSB v KPHDN

Read the full story on the RDS blog on “Transfer Pricing Adjustments: Applicability Of Section 140 Of The ITA”

https://www.rdslawpartners.com/post/transfer-pricing-adjustments-applicability-of-section-140-of-the-ita

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Bookkeeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsourcing bookkeeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancies in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

How to amend tax return after filing under S 131 of the Income Tax Act 1967

How to amend tax return after filing under S 131 of the Income Tax Act 1967

Overview

Inland Revenue Board (IRB) allows taxpayers to file an Amended Return Form (ARF) if taxpayers need to fix an error or mistake and result in under-payment of taxes.

However, how about if the taxpayer has overpaid the taxes because forgot to claim a tax credit or deduction in Income Tax Return Form (ITRF)? Don't worry, the taxpayer can make an application for relief under Section 131 and 131A of the Income Tax Act 1967 (ITA).

Let's see the conditions and procedure to be satisfied with the application.

Key takeaway:

You will understand:

1. What is considered an error or mistake in ITRF?

2. What are the time frames for the application?

3. What are the conditions for application?

4. How to apply for relief?

Summary of learning:

What is considered an error or mistake in ITRF?

The taxpayer had paid excessive tax because of the following reason:

- Error or omission to deduct an allowable expense

- Arithmetical error

- Misleading of laws

- Income for the previous YA is reported in current YA

- Other non-error or mistake, for example, approval of tax exemption under Promotion of Investment Act 1986.

What is the conditions for application?

The conditions under Section 131 and Section 131(A) of ITA are:

1. To take note that the application will not be considered if the ITRF is in accordance with known stand, rules and practices the DGIR prevailing at the time when the assessment is made.

o Example of the known stand, rules and practices are private ruling or advances ruling, guidelines by IRB, case law and any other written evidence.

2. Taxpayer must pay all the taxes for the relevant year of assessment.

3. Taxpayer must make an application within the time frames after the year assessment.

What are the time frames for the application?

The application for the relief can be made within the following time frames:

i. Within 5 years after the end of the year:

o The errors or mistakes found after the end of the year of assessment in which the assessment is deemed.

o Approval of any exemption, relief, remission, allowance or deduction is granted after year assessment in which the ITRF is furnished; or

o Deduction is granted under ITA or written law gazetted after the ITRF is furnished;

ii. Within 1-year after the end of the year:

o Deduction on expenses is allowed after the payment of withholding tax and related increased taxes.

How to apply for relief?

Taxpayers can make an application for relief by a letter or Form CP15C by stating the reason in detail relating to the application.

Sources:

Public Ruling 7/2020 Appeal Against An Assessment And Application For Relief

https://phl.hasil.gov.my/pdf/pdfam/PR_07_2020.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

(Latest update) Withholding Tax on Payments to Agents

(Latest update) Withholding Tax on Payments to Agents

With effect from Jan. 1, 2022, a 2% withholding tax (WHT) will be imposed on monetary payments made by companies to their authorized agents, dealers or distributors, arising from sales, transactions or schemes carried out by the Agents.

A new Section 107D of the Income Tax Act 1967 (ITA) was introduced under the Finance Bill 2021 following the Budget 2022 announcement on 29 October 2021.

The WHT is applicable on in-scope payments made to resident agents, dealers or distributors who are individual residents and who have received more than RM100,000 of such payments in monetary form and/or non-monetary form from the same company in the immediately preceding year of assessment (YA)

The tax withheld is to be remitted to the lRBM within 30 days from date of payment or crediting the payment to the agent, dealer or distributor.

Companies which fail to comply with this requirement will be subject to an increase in tax equivalent to 10% of the outstanding WHT and the underlying gross expenses which are subject to the WHT would be denied a tax deduction

Key salient points from IRB Response to Chartered Tax Institute of Malaysia Comments on 15/4/2022

1. LLPs are excluded from the definition of a payer company.

2. The definition of “Cash” includes transactions via payment vouchers, prepaid credit and e-wallets.

3. The WHT is applicable on the amount before the any contra transactions are made. Hence, the earlier comment in the FAQ that credit notes are excluded from the WHT.

4. Section 107D is applicable on ADD who receive the commissions based on the achievement of sales or services rendered for the payer company.

5. The WHT is not applicable to the payer company’s staff who are ADD if the commission is subjected and the commission is reported in the Form EA.

6. Out-of-pocket expenses incurred by the ADD have to be specifically identified in advance. If the expenses arise from sales, transactions or schemes carried out, then the WHT is applicable on the out-of-pocket expenses.

Source

IRBM has issued a Frequently Asked Questions (FAQ) dated 28 February 2022 (only available in Bahasa Malaysia) on the application of the above Section 107D.

https://phl.hasil.gov.my/pdf/pdfam/Soalan_Lazim_Seksyen_107D_ACP_1967.pdf

Reference :

Read our past posting on withholding tax on payment to agents in our blog

1. Withholding Tax on Payments to Agents dated on 17.03.2022

https://bit.ly/3L3JzOB

2. 2% withholding tax on commission dated on 30.12.2021

https://bit.ly/3hRrk20

3. 预算案 2022 dated 19.11.2021

https://bit.ly/3tKU7dM

4. Budget 2022 - SME edition dated on 18.11.2021

https://bit.ly/3IWhAiR

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Bookkeeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource bookkeeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

没有资格获得退税2%的补偿

没有资格获得退税2%的补偿

-

根据 ITA 在到期日之后提交的纳税申报表

-

根据 ITA 第 110 条抵销的税款超过应缴税款

-

IRB 根据 ITA 第 90(3)、91、91A、92 和 96A 条提出的评估。

-

纳税人申请延长报税时间。

-

有人对评估提出上诉

-

在提交截止日期后的 90 或 120 天内,IRB 审计需要缴纳额外的税款

-

支付的超额税款不是根据 ITA 第 107,107B 和 107C 条分期付款

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our external community for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Secretarial, Account/Payroll, Advisory)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

退税2%的补偿

退税2%的补偿

你有权获得 2% 的补偿. 如果 IRB 迟退还 (refund) 多付的税款 (tax overpayment)

Terms & Conditions :

1. 在截止日期前提交所得税申报表. 所得税申报表必须按时,完整和正确提交.

2. 可退税的纳税类型

-

PCB:每月减税

-

CP500:分期付款通知书

-

CP204/CP205:估计公司/有限责任合伙企业/社会应缴税款

计算公式

2%的赔偿金按照以下公式支付:

𝑻𝒂𝒙 𝒓𝒆𝒇𝒖𝒏𝒅 × (𝑻𝒐𝒕𝒂𝒍 𝒏𝒐.𝒐𝒇 𝒅𝒂𝒚𝒔 𝒍𝒂𝒕𝒆 )/(𝟑𝟔𝟓 𝒅𝒂𝒚𝒔 ) × 2%

-

通过电子填写, 自提交截止日期起 90 天后赔偿计算时间计算

-

通过邮寄/快递,自提交截止日期起 120 天后 赔偿计算时间计算

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our external community for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Secretarial, Account/Payroll, Advisory)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

How do you audit the opening balance for initial engagement?

How do you audit the opening balance for initial engagement?

Overview

The responsibilities and requirements to perform an audit of opening balances of the financial statements by a new auditor is outlined in the International Standard on Auditing (ISA) 510 Initial Audit Engagements – Opening Balances

The objective of audit opening balance

The objective of the auditor with respect to opening balances (OB) is to obtain sufficient appropriate audit evidence about whether:

1. The OB contain misstatements that materially affect the current period’s financial statements.

2. Appropriate accounting policies reflected in the OB that have been consistently applied in the current period’s financial statements or changes thereto are appropriately accounted for and adequately presented and disclosed in accordance with the applicable financial reporting framework.

The audit procedures

The auditor shall perform such additional audit procedures as are appropriate in the circumstances to determine the effect on the current period’s financial statements if the OB contain misstatements that could materially affect the current period’s financial statements.

General Audit Procedures

-

The auditor shall read the most recent financial statements including disclosures.

-

The auditor shall determine whether the prior period’s closing balances have been correctly brought forward to the current period or, when appropriate, have been restated.

-

The auditor shall obtain sufficient appropriate audit evidence to determine whether the opening balances reflect the application of appropriate accounting policies.

-

The auditor shall obtain sufficient appropriate audit evidence to review the predecessor auditor’s working papers to obtain evidence regarding the opening balances.

-

The auditor shall obtain sufficient appropriate audit evidence to perform specific audit procedures to obtain evidence regarding the opening balances.

Predecessor action

What can be done if the predecessor auditor does not, or cannot, provide access to the audit working papers for the previous reporting period?

The successor auditor should evaluate whether audit procedures performed in the current period provide evidence relevant to the opening balances, or perform specific audit procedures to obtain evidence regarding the opening balances, and propose opening balance adjustments, if necessary.

The auditor might want to recompute the allowance for doubtful debts accounts at the end of the prior period and compare original and recomputed numbers for consistency and reasonableness.

The auditor might want to review the property and equipment and its depreciation schedules for the prior year to compare them to the opening balances, as well as review the consistency of depreciation policies.

Source :

MIA Accountant Today

ISA 510 Opening Balances dated 14 January 2020

https://www.at-mia.my/2020/01/14/isa-510-opening-balances/

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Tax Responsibility of Employer

Tax Responsibility of Employer

Overview

As an employer, are you aware of the responsibilities and deadlines you have to adhere to? To make sure that you do not miss the deadline, here is the summary to help you.

Key takeaways:

You will understand the responsibility and consequences as follows: --

1. Who is the employer?

2. What are the employer’s responsibilities?

3. What are the consequences of failing to comply?

Summary of learning

1. Who is the employer?

- The employer has included Company, Limited Liability Partnership, Partnership, Enterprise and etc.

2. What are the employer’s responsibilities?

a) Register an Employer’s number (E)

The E number can be registered through https://edaftar.hasil.gov.my/.

b) Monthly Tax Deduction (MTD)

The MTD must be calculated based on the employee’s monthly remuneration and remitted to IRBM on or before the 15th of the subsequent month.

c) Employee’s Statement of Remuneration (Form EA)

Form EA has to be prepared and provided to employees on or before the last day of February of the following year.

d) Return Form of Employer (Form E)

Complete and submit the Form E with C.P.8D on or before 31 March of the following year via e-Filing.

e) Notification of New Employee (CP22)

To notify IRBM who is or is likely to be chargeable to tax within 30days after commencement of employment and submitted to any IRBM office.

f) Notification of cessation of employment or cessation by reason of death for an employee in private section (CP22A)

To notify IRBM who is or is likely to be chargeable to tax not less than 30days before the cessation of employment and submitted online via e-SPC or at IRBM office which handles the employee income tax number.

g) Notification of cessation of employment or cessation by reason of death for an employee in the public sector (CP22B)

To notify IRBM who is or is likely to be chargeable to tax not more than 30days after being informed of the death and submitted online via e-SPC or at IRBM office which handles the employee income tax number.

h) Notification of employee leaving Malaysia for more than 3 months (CP21)

To notify IRBM who is chargeable to tax not less than 30days before the expected date of departure and submitted online via e-SPC or at IRBM office which handles the employee income tax number.

i) Statement of monetary & non-monetary incentive payment to an agent, dealer or distributor pursuant to Section 83A of the Income Tax Act 1967 (CP58)

- To prepare the CP58 for its agents, dealers, and distributors.

- To render the CP58 by 31 March of the following year to its agents, dealers, and distributors, if the amount of incentive (monetary and non-monetary) exceeds RM5,000 during the calendar year.

- If LHDN requests for a listing of CP58 information, the employer shall include all information of the agent, dealer or distributor even if the amount is below RM5,000.

j) Withholding Tax (WHT) on Payments to agent, dealer or distributor

Effective from 1 January 2022, the 2% WHT will be imposed on monetary payments made by companies to their authorized agents, dealers or distributors, arising from sales, transactions or schemes carried out by the Agents.

3. What are the consequences of failing to comply?

a) Failure to furnish a Return Form

- Shall be liable to a fine of RM200 - RM20,000 or imprisonment for a term not exceeding six months of both.

b) Late payment

- 10% shall be imposed on the amount unpaid without any further notice.

Sources

Employer Responsibility

https://www.hasil.gov.my/en/employers/responsibility-of-employer/

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

What is the tax treatment for the income received by medical practitioners (Specialist Doctors)?

What is the tax treatment for the income received by medical practitioners (Specialist Doctors)?

IRB has produced a guideline on tax treatment for specialist doctors again.

Summarised below are the key salient points :

Case study 1

A specialist doctor with a Sdn Bhd has an agreement with a private hospital.

- Doctor has received consultation fees from the hospital.

- Patient was referred by the private hospital and paid to the hospital directly.

- Facilities in the private hospital have been used during medical treatment.

Tax treatment: The consultation fee received shall be reported under S4(a) of ITA 1967 as individual business income.

Case study 2

A specialist doctor with a Sdn Bhd has been involved in consultation services and medical-related fields (i.e. medical goods trading, pharmaceuticals, and health aids).

Tax treatment: As there are two types of income, it shall be declared with separated sources of income.

a) The consultation fee received shall be reported under S4(a) of ITA 1967 as individual business income.

b) The medical goods trading income shall be reported under S4(a) of ITA 1967 as individual or company business income.

*** Form B: S4(a) of ITA 1967 as individual business income

*** Form C: S4(a) of ITA 1967 as company business income

Case study 3

A specialist doctor with a Sdn Bhd owns a clinic in a private hospital.

- Patient visits the clinic directly without any referral by the private hospital.

- No facilities in the private hospital are being used during medical treatment.

Tax treatment: The consultation fee received shall be reported under S4(a) of ITA 1967 as company business income.

Case study 4

A specialist doctor under an employment contract with a private hospital.

- Doctor has received director remuneration from the hospital.

Tax treatment: The director remuneration received shall be reported under S4(b) of ITA 1967 as employment income.

Expenses can be claimed against S4(a) business income of ITA 1967

Condition: The expenses incurred are wholly and exclusively in the production of gross income.

Example for expenses:

-

Professional indemnity insurance

-

Seminars, workshops or conferences approved by CPD Review Committee

-

Rental of equipment/ operating room in a private hospital

-

Medical practitioner license and etc.

Capital allowance can be claimed against S4(a) business income of ITA 1967

Persons Eligible to Claim Capital Allowances

-

A person who is carrying on a business;

-

Has incurred capital expenditure on an asset for the business;

-

The asset is used for business purposes.

Source:

Garis Panduan Layanan Cukai Ke Atas Pendapatan Pengamal Perubatan (Doktor Pakar) Di Hospital Swasta Sama Ada Ditaksir Di Bawah Individu Atau Syarikat

https://bit.ly/37bHJfQ

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

How are joint ventures accounted for?

How are joint ventures accounted for?

i. What is an investment in a joint venture?

- A contractual agreement involved two or more parties.

- The parties involved have joint control over the business activity.

ii. Types of Joint venture

- Jointly controlled operations

- Jointly controlled assets

- Jointly controlled entities

iii. Recognition and measurement

1. Jointly controlled operations

Definition:

- Two or more venturers use their resources or expertise to produce a product.

- Each venture bears its expenses and liabilities and raises its finance.

- The revenue from the sale of the joint product and any expenses incurred in common are shared among the venturers.

Recognition in venturer's financial statements:

- Assets and liabilities incurred

- Expenses incurred and share of income

2. Jointly controlled assets

Definition:

- The joint control, and often the joint ownership, of assets dedicated to the joint venture.

Recognition in venturer's financial statements:

- share of the jointly controlled assets

- share of any liabilities incurred jointly or incurred by the venturer

- share of income

- share of expenses incurred.

3. Jointly controlled entities

Definition:

- A corporation, partnership, or other entity in which each venturer has an interest.

Recognition in venture’s financial statements:

(i) Cost model

- Cost less accumulated impairment losses

- Recognise distributions received from the investment as income

(ii) Equity model

- Recognise at the transaction price (including transactions costs)

- Subsequently adjusted to reflect the investor’s share of the profit or loss

(iii) Fair value model

- Initially, measured at transaction price (exclude transaction cost).

- Subsequently, measured at fair value, any changes recognized in profit or loss

4. What differentiates an interest in the joint venture from an investment in an associate?

Investment in associate = The investor has significant influence over the investee, by possessing the power to participate in their financial and operating decisions.

Joint venture = The parties involved have the power to joint control over the arrangement.

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Tax clearance Malaysia LHDN

Tax clearance Malaysia LHDN

Latest tax audit operasi

IRB has initiated tax audit on the following

1. CP21 - Notification by Employer on Employee's departure from Malaysia

http://phl.hasil.gov.my/pdf/pdfborang/CP21_Pin.1_2021.pdf

2. CP22 - Notification of New Employee

http://phl.hasil.gov.my/pdf/pdfborang/CP22_Pin.1_2021.pdf

3. CP22A - Notification of Cessation of Employment

http://phl.hasil.gov.my/pdf/pdfborang/CP22A_Pin.1_2021.pdf

Penalty on non-compliance on CP21, CP22 & CP22A

Delay in submitting the application for tax clearance may be subjected to penalty. The penalty will be in the form of fines between MYR 200 and MYR 20,000 and imprisonment for up to six months.

LHDN may take legal action against the employer who fails to pay the outstanding tax as per the Tax Clearance Letter.

How to submit CP21 + CP 22A online via IRB e-SPC.

STEP 1: Go to LHDN Website: https://ez.hasil.gov.my (网站)~ Key in New IC number

STEP 2: Key in password

STEP 3: Select e-SPC

STEP 4: Key in Employer’s number

STEP 5: Select Form and Key in accordingly

-

CP22A – Private (私人公司)

-

CP22B – Government (政府)

-

CP21 – Foreign Leaver (外国人)

STEP 7: Select Log Out

What documents IRB ask for?

Basically these are the documents required in a typical tax audit on employer on CP21, CP22 & CP22A :

•Staff listing

•Form E – Return of C.P.8D

•Form 22

•Form 21

•Form 22A

•Payroll System Data

•Latest of Form 9, 24,49 and 13

•Borang D(Kaedah 13)and Borang A(Maklumat Perniagaan)

•Form EA/EC

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

New e-Telegraphic Transfer (e-TT) System for Tax Payments

New e-Telegraphic Transfer (e-TT) System for Tax Payments

Following the Inland Revenue Board (“IRBM”)’s media release on 3 March 2022, the IRBM has rolled out the new e-TT system which will generate a unique Virtual Account Number (VA) as a payment identification.

This will assist the IRBM to trace the electronic transfer of funds by taxpayers to its accounts and identifying the taxpayers.

Effective from 1 April 2022, taxpayers who wish to make payments through Telegraphic Transfer, Electronic Funds Transfer and Interbank Giro from within and outside Malaysia, are required to obtain a Virtual Account Number.

Key summary of the new e-TT system for tax payment

1. Virtual Account (VA) number is required as a payment identification identity from IRBM for tax payment with effect from 1st April 2022.

2. Taxpayer will receive the e-TT notification in your email from IRBM.

3. Each VA number is limited to one transaction.

4. In case of withholding tax (WHT) payment, do remember to email the FULL documents to WHToperasi@hasil.gov.my on the day of payment.

5. & more

Type of tax payments

The Virtual Account Number generated under the e-TT system caters for the following types of taxes:-

(i) Income tax

(ii) Withholding tax

(iii) Petroleum income tax

(iv) Compound

(v) Public entertainer

(vi) Real Property Gains Tax – Section 21B retention sum payment

Each Virtual Account Number can only be used for one transaction.

Withholding Tax Payment operational issues

In case of WHT payment, do remember to email the FULL documents to WHToperasi@hasil.gov.my on the day of payment.

Full documents :

-

Completed CP tax payment form

-

Invoice

-

Proof of payment

-

Virtual Account No.

Source

1.Read the media release from IRBM on e-TT

Click https://bit.ly/37ptnID

2.How to generate a Virtual Account Number (VA) as a payment identification identity from IRBM?

Click https://bit.ly/3JhHe0K

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

How BAD is a Qualified Audit Report?

How BAD is a Qualified Audit Report?

Overview

Under the Companies Act 2016, all companies incorporated in Malaysia must have their accounts audited by an approved auditor. The auditor will examine the financial statements and records of the company, to ensure that all reports and documents are accurate and free from misstatement. If the auditor is not able to conclude that the financial statements are free from material misstatement, they express a modified opinion.

Key takeaways:

You will understand: -

1. What is a modified audit report?

2. What are the types of modified audit reports?

3. What are the circumstances that can lead to a modified audit opinion?

4. What are the consequences of a modified audit report?

Summary of learnings:

1. What is a modified audit report?

- A modified audit report can be defined as the financial statements which are not free from material misstatement. In simple words, a modified audit report means an audit report which is not clean in the opinion of the auditor.

2. What are the types of modified audit reports?

- Qualified Opinion

- Adverse Opinion

- Disclaimer of Opinion

3. Circumstances when a modified auditor’s opinion is required

The auditor shall express a modified opinion when:

- There is a limitation of scope in the auditor’s work to obtain sufficient audit evidence.

- Disagreement with management regarding the application of accounting policies.

- The financial statements are not free from material misstatement based on the audit evidence obtained.

4. What are the consequences of a modified audit report?

-It is unfavourable for financial institutions to provide loans to the company. The financial institution may offer a higher borrowing interest rate than the market rate.

- The existing banking facilities of the company may be terminated by the financial institution.

-The suppliers of the company may shorter the credit terms.

Source:

ISA705 (Revised): Modifications to the Opinion in the Independent Auditor’s Report

https://www.mia.org.my/v2/downloads/handbook/standards/ISA/2018/08/08/ISA_705_Revised.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Difference Between GAAP vs IFRS

Difference Between US GAAP vs IFRS

US GAAP vs IFRS are the two most dominant systems of accounting. The International Financial Reporting Standards (IFRS) are used by international companies while companies use GAAP in the U.S.

Summarised are the key difference on these US GAAP vs IFRS

-

International Accounting Standard Board vs Financial Accounting Standard Board

-

USA vs The rest of world

-

Rule based vs Principal based with flexibility

-

General interpretation for the entity vs Specific procedure for the entity

-

LIFO as preferred method for inventory valuation vs LIFO is not preferred for inventory valuation

-

Cost model on PPE vs Cost & Revaluation model can be used on PPE

-

Fair value on intangible assets vs Future economic benefits on the intangible assets

-

R&D is expensed off vs Some development cost can be capitalized and amortised

-

Extraordinary & unusual items are show below net profit vs Not allowed

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

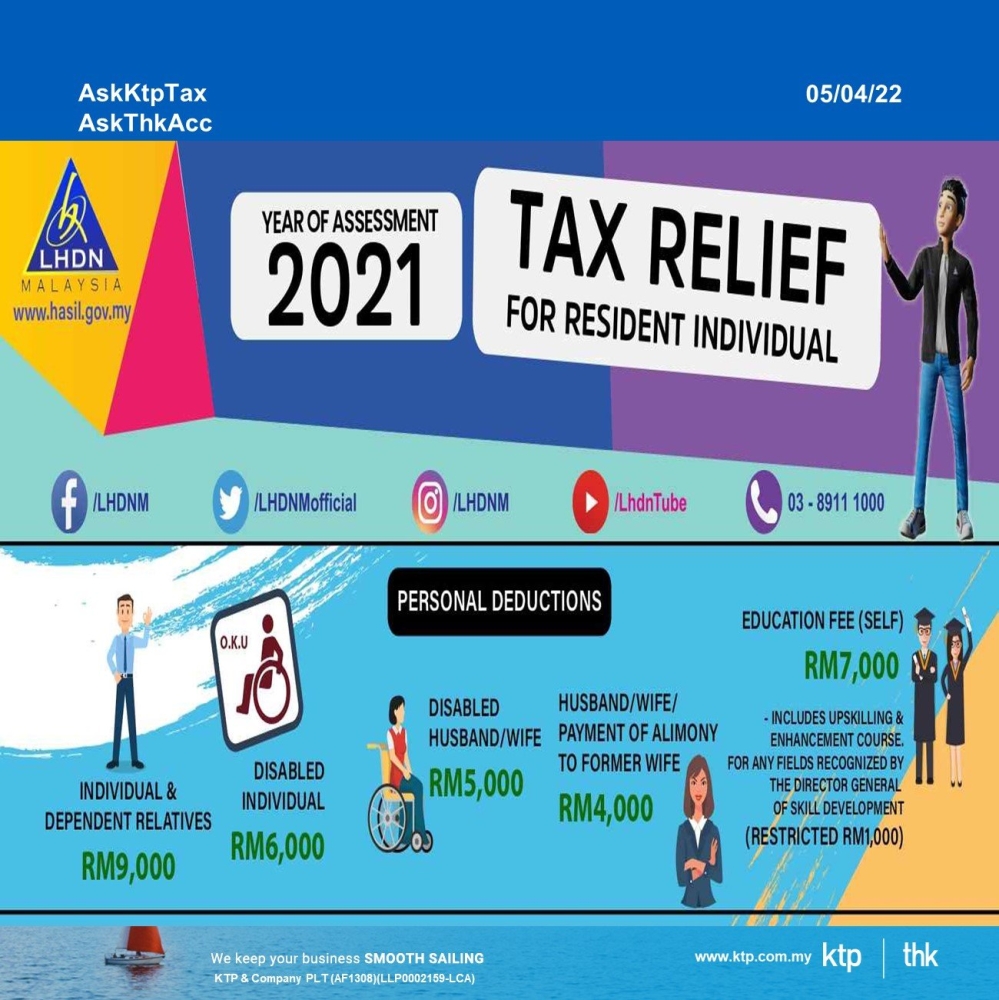

Personal Income Tax Relief 2021 Malaysia

Personal Income Tax Relief 2021 Malaysia

It is tax season whereby taxpayers are to file tax returns and pay taxes accordingly. Other than truthfully declaring your income and reliefs, and submitting your tax files before the deadline stipulated by LHDN, taxpayers are also responsible for record-keeping.

.What is the 2021 personal deduction?

With that, here’s the full list of tax reliefs for YA 2021.

1.Individual and dependent relatives - RM9,000

2. Medical treatment, special needs and carer expenses for parents (Medical condition certified by medical practitioner) - RM8,000 (Restricted)

3. Purchase of basic supporting equipment for disabled self, spouse, child or parent - RM6,000 (Restricted)

4. Disabled individual - RM6,000

5.Education fees (Self)

-

Other than a degree at masters or doctorate level - Course of study in law, accounting, islamic financing, technical, vocational, industrial, scientific or technology

-

Degree at masters or doctorate level - Any course of study

-

Any course of study undertaken for the purpose of up-skilling or self-enhancement recognized by the Director General of Skills Development under the National Skills Development Act 2006 – effective from YA 2021 until YA 2022. (Restricted to RM1,000)

RM7,000 (Restricted)

6. Medical expenses for serious diseases for self, spouse or child - RM8,000 (Restricted)

7. Medical expenses for fertility treatment for self or spouse

8. Vaccination expenses for self, spouse and child. Types of vaccines which qualify for deduction are as follows:

-

Pneumococcal;

-

Human papillomavirus (HPV);

-

Influenza;

-

Rotavirus;

-

Varicella;

-

Meningococcal;

-

TDAP combination ( tetanus-diphtheria-acellular-pertussis); and

-

Coronavirus Disease 2019 (Covid-19)

RM1,000 (Restricted)

9 (i) Complete medical examination for self, spouse, and child as defined by the Malaysian Medical Council (MMC).

(ii) COVID-19 detection test including purchase of self detection test kit for self, spouse, child.

RM1,000 (Restricted)

10. Lifestyle – Expenses for the use / benefit of self, spouse or child in respect of:

-

purchase and subscription of books / journals / magazines / newspapers (including electronic subscription) / other similar publications (Not banned reading materials)

-

purchase of personal computer, smartphone or tablet (Not for business use)

-

purchase of sports equipment for sports activity defined under the Sports Development Act 1997 and payment of gym membership

-

payment of monthly bill for internet subscription (Under own name)

RM2,500 (Restricted)

11. Lifestyle – Purchase of personal computer, smartphone or tablet for self, spouse or child and not for business use

This deduction is an addition to the deduction granted under item 10.

RM2,500 (Restricted)

12. Purchase of breastfeeding equipment for own use for a child aged 2 years and below (Deduction allowed once in every 2 years of assessment) - RM1,000 (Restricted)

13. Payment for child care fees to a registered child care centre / kindergarten for a child aged 6 years and below - RM3,000 (Restricted)

14. Net deposit in Skim Simpanan Pendidikan Nasional (Net deposit is the total deposit in 2021 MINUS total withdrawal in 2021) - RM8,000 (Restricted)

15. Husband / wife / payment of alimony to former wife- RM4,000 (Restricted)

16. Disabled husband / wife - RM5,000

17. Each unmarried child and under the age of 18 years old- RM2,000

18. Each unmarried child of 18 years and above who is receiving full-time education (''A-Level'', certificate, matriculation or preparatory courses).

RM2,000

19. Each unmarried child of 18 years and above that:

-

receiving further education in Malaysia in respect of an award of diploma or higher (excluding matriculation/ preparatory courses).

-

receiving further education outside Malaysia in respect of an award of degree or its equivalent (including Master or Doctorate).

-

the instruction and educational establishment shall be approved by the relevant government authority.

RM8,000

20. Disabled child - RM6,000

Additional exemption of RM8,000 disable child age 18 years old and above, not married and pursuing diplomas or above qualification in Malaysia @ bachelor degree or above outside Malaysia in program and in

Higher Education Institute that is accredited by related Government authorities

RM8,000

21. Life insurance and EPF INCLUDING not through salary deduction

-

Pensionable public servant category

-

Life insurance premium

-

-

OTHER than pensionable public servant category

-

Life insurance premium (Restricted to RM3,000)

-

Contribution to EPF / approved scheme (Restricted to RM4,000)

-

RM7,000 (Restricted)

22. Deferred Annuity and Private Retirement Scheme (PRS) - with effect from year assessment 2012 until year assessment 2025 - RM3,000 (Restricted)

23. Education and medical insurance (INCLUDING not through salary deduction) - RM3,000 (Restricted)

24. Contribution to the Social Security Organization (SOCSO) - RM250 (Restricted)

25. Payment for accommodation at premises registered with the Commissioner of Tourism and entrance fee to a tourist attraction

(Expenses incurred on or after 1st March 2020 until 31st December 2021)

Registered accomodation premises can be check thru link of : http://www.motac.gov.my/en/check/registered-hotel

RM1,000 (Restricted)

26. Additional lifestyle tax relief related to sports activity expended by that individual for the following:

-

Purchase of sport equipment for any sports activity as defined under the Sport Development Act 1997 (excluding motorized two-wheel bicycles);

-

Payment of rental or entrance fee to any sports facility; and

-

Payment of registration fee for any sports competition where the organizer is approved and licensed by the Commissioner of Sports under the Sport Development Act 1997.

RM500 (Restricted)

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Bad debts written off LHDN

一定要出律师信坏账才可以扣税吗?

让我们参考 IRB Public Ruling 4/2019 坏账被定义为 在采取适当措施收回后被认为无法收回的债务 :

-

发出提醒通知

-

债务重组计划.

-

债务清偿的重新安排.

-

有争议的债务的谈判或仲裁.

-

法律诉讼.

IRB Tax Ruling

Public Ruling No 4/2019 states bad debt is defined as a debt that is considered not recoverable after appropriate steps have been taken to recover it.

Public Ruling No 4/2019 described the basis of writing off a debt as bad and the actions to be taken to recover the debt as well as the evidence to prove such actions have been taken.

Reasonable steps have been taken to recover the trade debt:

-

Issuing reminder notices

-

Debt restructuring scheme

-

Rescheduling of debt settlement

-

Negotiation or arbitration of a disputed debt

-

Legal action

KTP/THK key takeaways

不必要出律师信....坏账才可以扣税吗?

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Why do auditors audit related party transactions?

Why do auditors audit related party transactions?

Theoretically, related party transactions carry no higher risk to the financial statement if compared to those unrelated.

But why the auditor is so concerned about related party transactions?

This is because the nature of related party transactions may present a greater opportunity for collusion, concealment, or manipulation by management, resulting in a false result in the financial statements.

Responsibilities of auditor

The auditor shall: -

1. Identify and assess the Risks

2. Responses to the Risks

3. Evaluate the accounting treatment and disclosure

To conclude whether the related party transactions achieve fair presentation and are not misleading

Here are some examples of what auditor may need to inspect, which entity can generate internally: -

1. Minutes of meetings

2. Statements of conflicts of interest

3. Contracts and agreements

4. Invoices and correspondence from the entity’s professional advisors

5. Reports of the internal audit function

Source: https://www.mia.org.my/v2/downloads/handbook/standards/ISA/2018/06/01/ISA_550.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

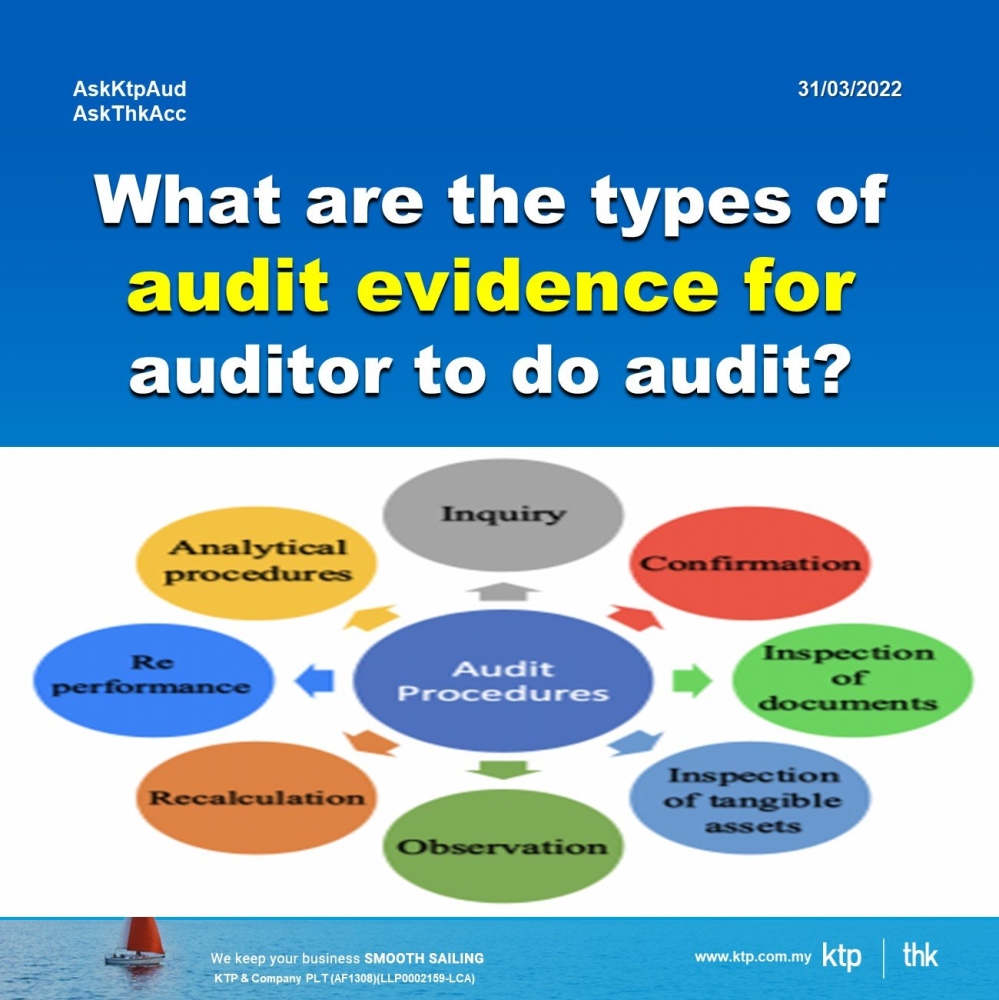

How does audit work in Malaysia?

How does audit work in Malaysia?

Overview

International Standards on Auditing (ISA) 500 – audit evidence is a procedure to enable the auditor to obtain sufficient appropriate audit evidence to draw a reasonable conclusion on the auditor’s opinion.

Audit evidence consists of the documents you use during an audit to substantiate your audit opinion. While working on an audit, you encounter many different types of evidence (written, oral, and so on).

Key takeaway

You will understand:

(a) Sources of audit evidence

(b) Audit evidence procedure

(c) Quality of the audit evidence

(d) The four concepts of audit evidence

Summary of learning

1. Sources of audit evidence

• Testing the accounting records

• Different sources/natures or independent parties in the entity

• 3rd party’s information/ confirmation

2. Audit evidence procedure:

• Inspection

Internal/external, paper/electronic form, physical examination

• Observation

Looking at a process or procedure being performed such as inventory counting

• External Confirmation

A direct written response to the auditor from a third (confirming) party

• Recalculation

Checking the mathematical accuracy of documents or records

• Reperformance

Auditor’s independent execution of procedures or controls

• Analytical procedures

Evaluations of financial information through analysis among financial and non-financial data

• Inquiry

Seeking information of the knowledgeable person, both financial and non-financial, within or outside entity.

3. The quality of audit evidence is affected by:

• Relevance; and

• Reliability of the information based

4. The four concepts of audit evidence

-

Nature

The form of the evidence — for example, oral, visual, or written.

-

Appropriateness

The quality, relevancy, and reliability of the evidence.

-

Sufficiency

The quantity of audit evidence — enough evidence to evaluate the audit client’s management assertions.

-

Evaluation

A decision on whether the evidence is compelling enough to allow you to form an opinion.

Sources

https://www.mia.org.my/v2/downloads/handbook/standards/ISA/2020/01/ISA_500.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

What is the royalty based method of intangible assets valuation?

What is the royalty based method of intangible assets valuation?

The relief from royalty (RFR) approach is based on the idea that the fair value of an intangible asset equals the present value of the cost savings realized by the owner of the asset that results from not having to pay royalties for the use of the intangible asset to another party.

Relief from royalty method under income approach on trade names, brands and technology assets.

There is various legislation governing IP rights available in Malaysia from the Patents Act, Industrial Design Act, Trade Mark Act & Copyright Act

In short, the RFR is based on the measurement of the license payments, from a market database, which has been saved as a consequence of having ownership of the assets.

Six steps on relief from royalty methods

Step 1: Set the preliminary

1.1 Purpose of valuation

1.2 Standard or basis of value (market vs investment vs liquidation value)

1.3 Premise of value

Step 2: Understand the subject intangible assets

Step 3: Estimate economic benefits (revenue projection)

Step 4: Estimate hypothetical royalty rate

4.1 25% on gross margin, profit margin, EBIT, OPM, EBITDA

The “25 percent rule” is a general rule of thumb that suggests, as a starting point in a negotiation, that a licensee would pay 25 percent of its expected profits as a royalty for products that incorporate the licensed intellectual property (IP)

4.2 Industry royalty rate: RoyaltySource

RoyaltySource has been tracking intellectual property news and licenses related to technology (patent, know-how, trade secret, and business method), software, trademark, trade name, brand or logo, copyright and right of publicity for 30 years..

4.3 Company disclosures: Audited financial statement, paid subscription (Bloomberg, S&P Capital IQ), Free (Yahoo Finance, Bursa, Malaysiastock.biz)

4.4 Transactional approach

Step 5: Estimate discount rate

5.1 Weighted average cost of capital (WACC)

5.2 Cost of equity = R (risk free) + beta {R(market)-R(risk free)}

Step 6 : Calculation (to be continued)

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Will you slap your auditor just like Will Smith in Oscar 2022

Will you slap your auditor just like Will Smith in Oscar 2022

Are auditors happy?

Auditors are one of the least happy careers in the United States. At CareerExplorer, we conduct an ongoing survey with millions of people and ask them how satisfied they are with their careers. As it turns out, auditors rate their career happiness 2.5 out of 5 stars which puts them in the bottom 4% of careers.

How stressful is auditing?

Auditing is considered a stressful occupation because the job is often characterized by heavy workloads, many deadlines, and time pressures.

Is auditing exciting?

Although auditing is sometimes jokingly described as a not-so-exciting career involving a lot of long hours, the truth is that it offers both variety and opportunities for continued development.

What is busy season for auditors?

When is busy season? In the audit practice, this period of time occurs every year from March to July, but that timeline can depend on when your client's fiscal year-end is and whether they are a public or private company.

How do you survive a busy season (a per AICPA)?

-

Early on

-

Send up a flare. Remind family, friends, and the rest of your circle about what's going on in your work life. ...

-

Pass the torch. Let someone else be the social chair. ...

-

Holster that phone. ...

-

Make sure you're reachable. ...

-

Make time to recharge. ...

-

Eat in. ...

-

Prepare for letdown. ...

-

Bank some sanity.

When is busy season end?

Regardless of what field of accounting you are in, busy season usually falls in the third quarter of the year. The reason for this is that most companies traditionally have a December 31st year end.

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Can a company loan to its director?

Can a company loan to its director?

With the entire globe weathering COVID-19, directors may encounter hardship in obtaining a personal loan from the approved financial institution. The option to get a loan from a financial institution is always available in the market; however, the requirement and fulfilment to obtain the loan is getting difficult compared to the old times. Is there any alternative option available for directors? Can directors take a loan from the company?

General ruling on loan to directors

A company’s constitution may give the power to its board of directors to lend money; however, Section 224(1) of Companies Act (CA) 2016 generally prohibits a company from:

a) giving loans; or

b) securities for loans

to its directors and related companies as defined under Section 7 of CA2016.

Exceptions

However, there are circumstances that allow for a company to give loans or provide any security for loans to directors as accordance with Section 224 (2) with the below criteria:

1. foreign company;

2. exempt private company;

3. loan to the director whereby enable him to meet the expenses incurred for the purposes of the company or to ease him to perform his duties as an officer;

4. provide funds to the director (full-time employment with the company or its holding company) to meet his expenditure incurred in purchasing a house; and

5. loan to the director (full-time employment with the company or its holding company) by passing a resolution to approve the loan schemes by the members at the general meeting.

Section 224(3) of CA 2016 clearly stated that a company shall not authorise the making of any loan or securities for loans to the director unless obtained prior approval from the company on the resolution to disclose the purpose and the amount of the loan.

Last minutes remedy

What if the company authorised the loan without prior approval on the resolution? Any other remedies for this?

Yes, the company may authorise the making of loans or securities for loans to the director:

1. at or before the next following Annual General Meeting for a public company;

or

2. within six months from the making of the loan or securities for the loan to the director for a private company.

Contravention

What are the consequences of contravention of this section?

The company shall recover the loan and discharge the securities given in contravenes with this section.

Reference is made to a legal case Harta Empat Sdn Bhd v Koperasi Rakyat Bhd [1997] where the Court of Appeal decision that security created pursuant to a loan that contradicts with this Section was deemed invalid.

Referring to the Section 224(6), the directors will be jointly and severally liable to indemnify against any loss incurred. Upon conviction, a penalty will be imposed and be subject to imprisonment for a term not exceeding 5 years or a fine not exceeding RM3million or both according to Section 224(10) of CA2016.

Conclusion

In conclusion, it is clear that Section 224 of the Companies Act 2016 prohibits loans or providing securities to its directors unless there is a resolution approving such loan passed by its members. This section protects the company, its shareholder, and creditors as a precaution against any unlawful dilution of the company’s assets to the hands of directors or their related parties.

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Bookkeeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, bookkeeping and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks