Blog

Solvency Test in Dividend Distribution

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

- Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

- Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

𝐊𝐓𝐏

- Website www.ktp.com.my

- Instagram https://bit.ly/3jZuZuI

- Linkedin https://bit.ly/3sapf4l

- Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

- Tiktok http://bit.ly/3u9LR6Q

- Youtube http://bit.ly/3ppmjyE

- Facebook http://bit.ly/3ateoMz

- Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

- Instagram https://bit.ly/3u2PxHg

- Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

- Website www.thks.com.my

- Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Dividend distribution : Steps

Do you know the steps on dividend distribution under S132 of CA 2016?

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐊𝐓𝐏

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Form EA 有什么?

Form EA 有什么?

Part A - 雇员的资料

-

姓名

-

工作职位

-

工作编号

-

IC号码

-

EPF 号码

-

加入日期和辞职日期(如果少于一年)

Part B - 就业收入,福利,住宿

-

收入

-

拖欠收入 (payment in arrears)

-

福利价值

-

住宿价值

-

未经’批准’的EPF或退休金退款

-

失业赔偿

Part C - 退休金

-

退休金

-

年金 (annuity)

Part D - 扣除总额

-

预扣税金

-

年金 (annuity)

-

CP 38 扣款 (税收局向积欠税款的纳税人雇主,发出“扣除工资令)

-

伊斯兰援助金 (Zakat)

-

员工通过表格TP1扣除的回扣金额

-

孩子回扣金额

Part E :Approved 退休金或公积金、基金或社团的缴纳总额

-

EPF

-

Sosco

Visit US

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

KTP Lifestyle (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

THK (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Medical Fee on director is a tax exempted BIK?

Under section 13(1) b Income Tax 1967, medical and dental benefits are exempted from income tax for employee?

But

Questions :

- Director of the control company = an employee of company for tax purpose?

- Does the exemption extend to directors of a controlled company like for any other employees of the company?

Under paragraph 8.3.1 , if the employee receiving BIK from the employer has control over his employer (company) is no exemption.

What is control?

For a company, the power of an employee to control is through :

- The holding of shares or

- The possession of voting power in or

- By virtue of powers conferred by the articles of association or other document.

What is control?

For a partnership, the employee is a partner of the employer.

For a sole proprietor, the employee and the employer is the same person

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Ask Secretarial : The basic requirement on dividend distribution

𝐊𝐓𝐏

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Ask Secretarial : Non compliance on dividend distribution

𝐊𝐓𝐏

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Latest update on CP 500

Overview of CP 500:

Every February or March of the year, the taxpayer shall receive the CP500 from LHDNM through post or email notification.

CP500 is a tax instalment scheme issued by LHDNM to individual taxpayer who carrying business income. For example, sole-proprietor, self-employed, partnership, person who received rental income or royalties.

Key takeaway:

You will understand:

a) What is CP500?

b) What is the due date for CP500?

c) What is the penalty for late payment on CP500?

d) Can taxpayer do revision for CP500?

e) Any penalty for revising CP500?

Summary of Learning

a) What is CP500?

This is the tax instalment issued by LHDNM for individual taxpayer who has income other than employment income such as business income, rental income and royalties.

If you not yet receive the letter by end of March, you may visit the tax office or contact LHDNM for more details.

However, taxpayer may not receive the CP500 if the taxpayer is making losses in last two years or just commenced the business.

b) What is the due date for CP500?

The tax estimate has to be paid bi-monthly in 6 instalments and the payment for each instalment should be made within 30 days from the date of payable (March, May, July, September, November and January).

c) What is the penalty for late payment?

If the taxpayer fail to make the tax instalment on time, LHDNM will impose a 10% penalty on the outstanding balance. The penalty is to be self-assessed and paid to the LHDNM.

d) Can taxpayer do revision for CP500?

Taxpayer is allowed to revise the CP500 by submitting Form CP502 to respective LHDNM Branch if they have any valid reason.

However, the revision must be submitted on or before 30 June of current year of assessment. LHDNM will issue the CP503X once they have approved for the revision.

e) Any penalty imposed for the revision?

If the revised tax payable (CP502) is 30% lower than actual tax payable, the difference will subject to a 10% penalty.

[(Actual tax payable – Estimated tax payable) – (30% x Actual tax payable)] x 10%

Sources:

CP502 Explanation Notes:

http://phl.hasil.gov.my/pdf/pdfam/CP502_NOTA_PENERANGAN_2.pdf

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

𝐊𝐓𝐏

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firm which commit to help and grow our clients business.

1分钟学习“如何在BIK / Perquisites计算PCB”

How to compute PCB on BIK or perquisites?

实物利益和额外津贴如何计算PCB?

Situation 1: Benefit-In-Kind (情况1:实物利益)

-

ABC Sdn Bhd provided motorcar with petrol to his employee – Mr X.

ABC Sdn Bhd 提供一辆汽车和汽油给员工- Mr X.

-

The motorcar cost is RM 120,000.00.

那辆汽车价值是RM 120,000.00.

-

According to prescribed value method the BIK value is RM 5,000.00 (motorcar) + RM 1,500.00 (petrol) = RM 6,500.00 per annum.

根据规定的价值方法,实物利益的价值是RM6,500一年 (RM 5,000.00 – 汽车 + RM 1,500.00 – 汽油)

-

Therefore, we must include the BIK value in monthly PCB calculation. The monthly BIK value is RM 6,500.00 / 12 months = RM 541.67. Then the BIK value of RM 541.67 required to fill under “benefit-in-kind” during the monthly PCB calculation

因此,我们必须在计算每月的预扣税中填写实物利益的价值。每月实物利益的价值是RM541.67 (RM6,500.00除12个月)

Situation 2: Perquisites 情况2:额外津贴

-

Ms Y received gift from her employer on her birthday.

Y小姐在生日当天收到老板送的一份礼物。

-

The gift is LV handbag.

那份礼物是LV包包。

-

LV handbag cost RM 6,550.00

LV包包价值 RM 6,550.00。

-

In this situation, the LV handbag value – RM 6,550.00 should include in the monthly PCB calculation (please refer to diagram 2).

在这种情况下,LV包包的价值- RM 6,550.00需要填写在每月计算的预扣税中。

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

When to declare bonus into Form EA? 花红几时需要报进Form EA?

𝐁𝐨𝐧𝐮𝐬 𝐄𝐱𝐚𝐦𝐩𝐥𝐞 : 𝐖𝐡𝐞𝐧 𝐭𝐨 𝐝𝐞𝐜𝐥𝐚𝐫𝐞 𝐛𝐨𝐧𝐮𝐬 𝐢𝐧𝐭𝐨 𝐅𝐨𝐫𝐦 𝐄𝐀? 花红几时需要报进Form EA?

Situation 1: 情况 1:

• ABC Sdn Bhd financial year ended is 31/12/2020.

ABC Sdn Bhd 年度财务报表截至于31/12/2020。

• Ms Account had accrued the bonus dated 31/12/2020 and paid out on 20/01/2021.

Account小姐姐应计花红在31/12/2020然后支出于20/01/2021。

• EPF and PCB submit under the month of January 2021.

公积金和每月预扣税申报于1月2021年。

In this case, the bonus should be filled under Form EA 2021.

在这情况下这笔花红需填写进2021年的Form EA。

Situation 2: 情况2:

• ABC Sdn Bhd financial year ended is 31/12/2020.

ABC Sdn Bhd 年度财务报表截至于31/12/2020。

• Ms Account had accrued bonus dated 31/12/2020 and paid out on 05/01/2021.

Account小姐姐应计花红在31/12/2020然后支出于05/01/2021。

• EPF and PCB submit under the month of December 2020.

公积金和每月预扣税申报于12月2020年。

Conclusion (结论)

-

The declaration of bonus is according to the payment date.

-

花红申报是根据付款日期。

-

In this case, the bonus should be filled under Form EA 2020.

-

在这情况下这笔花红需填写进2020年的Form EA。

Visit us :

KTP Website www.ktp.com.my

THK Website www.thks.com.my

KTP Instagram https://www.instagram.com/ktp_1308/

KTP Lifestyle Instagram https://www.instagram.com/ktp_lifestyle/

KTP Career Instagram https://www.instagram.com/ktp_career/

KTP Lifestyle Facebook https://www.facebook.com/KTPLifestyle

KTP Career Facebook http://bit.ly/3rPxz9o

KTP Linkedin https://www.linkedin.com/company/2828037/admin/

KTP Telegram https://t.me/ktpthkrescueplan

KTP Tiktok https://vt.tiktok.com/ZSJJucBrj/

KTP Youtube http://bit.ly/3ppmjyE

公司给顾客或供应商红包 可不可以扣税?

公司给顾客或供应商的红包可以扣税吗?

根据业务招待费中的第10条的第6项中提到的“给现金”是不能扣税的,例如赞助顾客年度晚宴的现金。

但是在业务招待费中的第7.7(c)条文中有提到,如果公司是因为推广新的产品时给予顾客的现金礼券,购物券等等就可以享有一百巴仙的扣税。

Supporting information

Public Ruling 4/2015 Entertainment Expense

7.7 The provision of entertainment related wholly to sales arising from the business - proviso (vii) to paragraph 39(1)(l) of the ITA.

Expenditure incurred on entertainment which is related wholly to sales arising from the business.

c) cash vouchers, discount vouchers, shopping vouchers, meal vouchers, concert or movie tickets;

10.6 Cash contribution for customer’s annual dinner

10.6 赞助顾客年度晚宴的现金

#KTP

#thk

#angpow

#irb

Visit us www.ktp.com.my

Visit us www.thks.com.my

公司给员工红包可不可以扣税?

公司给员工红包可不可以扣税?

根据1967年《所得税法令》的第13(1)(a) 条规,员工在工作中所获得的收益或利润的总收入(包括正在进行或有业务的员工所产生的任何工资,薪金,薪酬,休假工资,费用,佣金,奖金,酬金或津贴(无论是金钱还是其他形式))都视为就业收入的一种。

而员工收到的红包是属于额外津贴并包含在就业收入里。

根据1967年《所得税法令》的第33(1) 条规,支出或费用的税务减免皆是需为了产生收入。

因此,公司需要替员工把该收入呈报在年度薪酬表,才能享有该花费的税务减免。

Supporting information

Public Ruling 5/2019 Perquisites from Employment

http://phl.hasil.gov.my/pdf/pdfam/PR_05_2019_2.pdf

Paragraph 3.9 Definition of perquisites

“Perquisites”, in relation to an employment, means benefits in cash or in kind that are convertible into money received by an employee from the employer or third parties in respect of having or exercising the employment.

Paragraph 8.3 Employer’s Responsibilities

In accordance with subsection 83(1) of the ITA 1967, the employer is required to report in the employee's statement of remuneration (Form EA and EC) and Form E for the employer, all payments in respect of services provided by the employee including all types of perquisites. This includes the benefits provided for the spouse, family, servants, dependent or guest of the employee. The failure by the employer to comply with this subsection will render the employer liable to prosecution under subsection 120(1) of the ITA.

#KTP

#thk

#angpow

#irb

Visit us www.ktp.com.my

Visit us www.thks.com.my

Update on Tax Exempted Perquisites from Employment

Federal Government has gazetted the PU(A)30 Income Tax (Exemption) Order 2021 on 26.01.2021

But what is this???

PU(A)30 Income Tax (Exemption) Order 2021

Employee can enjoy the tax exemption in YA2020 up to RM5,000 from receiving the value of benefits on acquiring smartphone, tablets and personal computer!!

What other tax exemption on perquisite for YA2020?

-

Innovation or productivity award - RM2,000 exemption

-

Subsidies on interest : Housing, education or car loan - RM300,000

-

Gifts and monthly bills for fixed line telephone, mobile phone, pager, personal digital assistant (PDA) and subscription of broadband - Limited to only 1 unit for each category of assets

-

Travelling allowance, Petrol allowance or Toll rate - RM6,000 exemption

-

Parking rate or parking allowance - Reasonable

-

Meal allowance : Daily or monthly basis

-

Child care allowance : - RM2,400 - Age of 12 years

#KTP

#thk

#TaxExemption

#irb

Visit us www.ktp.com.my

Visit us www.thks.com.my

How to save tax on employee's salary? Part II

How to save tax on employee remuneration? Part 2

A simple practical illustration on tax exempted perquisites :

For years… Ah Huat (not director) receive RM10,000 bonus and subject to PCB RMx per month?

After tax planning..

Now Ah Huat receive RM8,000 monthly salary and RM2,000 cash reward on productivity award . Ah Huat monthly PCB is lower that RMx previously.

Example of tax exempted perquisites :

-

Innovation or productivity award - RM2,000 exemption

-

Subsidies on interest : Housing, education or car loan - RM300,000

-

Gifts and monthly bills for fixed line telephone, mobile phone, pager, personal digital assistant (PDA) and subscription of broadband - Limited to only 1 unit for each category of assets

-

Gift of a new personal computer - PU (A) 30 Income Tax (Exemption) Order 2021

For YA2020 only -

Travelling allowance, Petrol allowance or Toll rate - RM6,000 exemption

-

Parking rate or parking allowance - Reasonable

-

Meal allowance : Daily or monthly basis

-

Child care allowance : - RM2,400 - Age of 12 years

Source : IRB Public Ruling - Perquisites from Employment

http://lampiran1.hasil.gov.my/pdf/pdfam/PR_05_2019.pdf

#KTP

#thk

#TaxExemption

#irb

Visit us www.ktp.com.my

Visit us www.thks.com.my

员工薪酬 - 税务节省大秘密

员工薪酬 - 税务节省大秘密

如何进行员工薪酬 - 税务节省?

多年以来……阿发(不是董事)会获得10,000令吉的奖金(bonus),而且还需要PCB RMx吗?

经过this税务节省大秘密。.

现在,阿发将获得RM8,000的月薪和RM2,000的生产力奖状。阿发每月的PCB低于以前的RMx

员工收到这些东东是免税

-

创新或生产力奖 - RM2,000豁免

-

利息补贴住房,教育或汽车贷款 - RM300,000

-

固定电话, 手机,寻呼机 ,个人数字助理(PDA) 和宽频订购和月费 - 每个资产类别仅限于1个单位

-

赠送新个人电脑 - PU (A) 30 Income Tax (Exemption) Order 2021 For YA2020 only

-

交通津贴,汽油津贴或过路费 - RM6,000豁免

-

停车费或停车补贴 -限制停车费 -合理

-

膳食津贴:每日或每月

-

育儿津贴:RM2,400 & 12岁

How to save tax on employee's salary?

Tax Planning (via Tax Exempted Benefits) on Employee Remuneration

A simple technique on tax planning for taxpayer is to use tax exempted (free) benefits available under the sky.

A simple example to illustrate :

For years… Ah Huat (not director) receive RM10,000 monthly salary and subject to PCB RMx per month?

After tax planning..

Now Ah Hua receive RM8,000 monthly salary and RM2,000 child care benefit. Ah Hua monthly PCB is lower that RMx previously.

What is tax exempted benefits available?

1. Dental benefit

2. Child-care benefit

3. Food and drink provided free of charge

4. Free transportation between pick-up points or home and the place of work (to and from)

5. Insurance premium which are obligatory for foreign workers as a replacement to SOCSO contributions

6. Group insurance premium to cover workers in the event of an accident

7. Leave passage

- Leave passage in MY of not more than 3 times in one calendar year, or

- Oversea leave passage of not more than once in any calendar year limited to a maximum amount of RM3,000

8. Value of discount on goods will be exempted up to maximum RM1,000 and the goods can be provided fully or partially discounted by applying the sale price

9. Discounted price for consumable business products of the employer and discounted price for services provided by the employer

- Discount price for consumable business product of the employer (RM1000 max)

- Discount price for services provided by the employer

10. Modern medicine, traditional medicine and maternity

Disclaimer :

We make no representations or warranty (expressed or implied) about the accuracy, suitability, reliability or completeness of the information for any purpose.

We disclaim all responsibility, for the consequences of anyone acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Recipients should not act upon it without seeking specific professional advice tailored to your circumstances, requirements or needs.

#KTP

#thk

#TaxExemption

#irb

Visit us www.ktp.com.my

Visit us www.thks.com.my

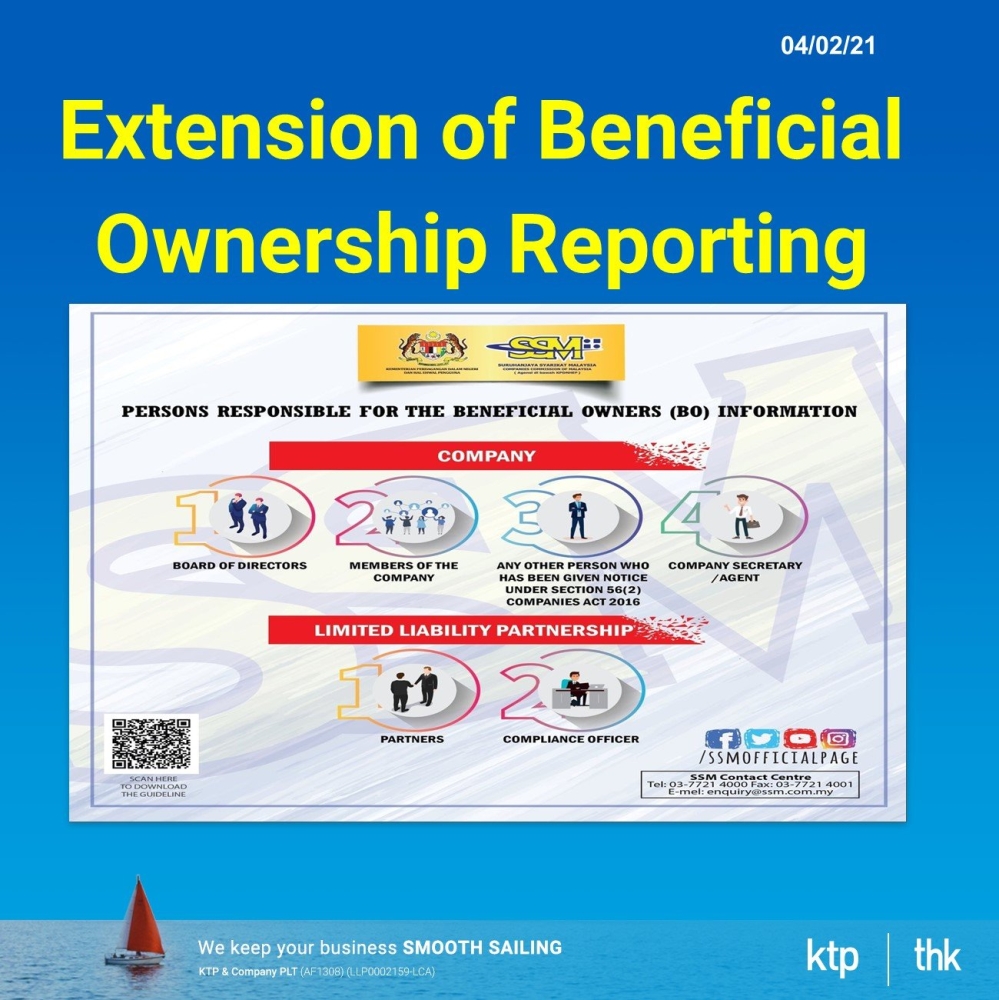

Update of Extension of SSM Beneficial Ownership (BO) Reporting

Update of Extension of SSM Beneficial Ownership (BO) Reporting

On 17 December 2020, Suruhanjaya Syarikat Malaysia (SSM) announced that the transitional period to report the BO which ends on 31 December 2020 has been extended to a later date to be determined by the registrar.

SSM highlighted the following matters related to the extension of the transitional period as extracted from the FAQ:

-

such extension is automatically granted to all companies without further application required;

-

such extension is given to allow all companies and company secretaries and/ or compliance officer to

-

-

familiarise with the reporting framework and to take necessary actions in accordance with the guideline; and

-

facilitate the concurrent operations of provisions relating to the BO.

-

During this extended transitional period, all companies shall

-

continue to identify and verify the beneficial owners to ensure the BO information is accurate and up to date;

-

ensure the information obtained is kept at the entity’s level;

-

ensure the information obtained is accessable promptly; and

-

lodge the BO information together with Annual Return.

Warning

Due to the importance of the BO, SSM will conduct inspections during this period to ensure companies comply with the BO reporting requirements. The Registrar has the power to issue guidelines and any person who fails to comply commits a breach where actions can be taken pursuant to Section 20E of the Companies Act, 2016.

For more information, click here:

- SSM Announcement - https://bit.ly/38EtUo9

- SSM FAQ - https://bit.ly/3oJoihV

Construction Accounting Q&A Part 4 - Tax Treatment

Confused over contract accounting Q&A Part 4

Today we cover Q&A #4 on tax treatment as per IRB Public Ruling 4/2009 Construction Accounting.

These is normal part of our training note to our clients and new colleagues on contract accounting.

1 Determine date of commencement

* Date of letter of award

Or

* Date of actively carry construction work

2 Recognition of income

* Contract more than 1 year

* Contract completed in different accounting period

3 Separate source of income - Different contract different source.

4 Estimate loss on uncompleted contract - Allow to set off against estimated gross profit

5 Completion of contract

* Obtain certificate of practical completion

* Tax treatment of actual gross profit/loss

6 Others

* Unliquidated damage

* Warranty/defect liability expenses

* Guarantee fee

Permai Assistance Package - Key summary

Permai Assistance Package

On 18 January 2021, the Prime Minister unveiled the Perlindungan Ekonomi & Rakyat Malaysia (PERMAI) Assistance Package, valued at RM15 billion.

The objectives of the Package are to:

1. Combat the COVID-19 outbreak

2. Safeguard the welfare of the people, and

3. Support business continuity

The key tax measures of Permai Assistance Package are highlighted below.

1. Further extension of special deduction on rental discount given to tenants ( Again where is the gazette order on rental discount in 2020? )

2. & etc.

Download Key Summary of Permai Assistance Package :

Visit us www.ktp.com.my

Visit us www.thks.com.my

IRB tax audit on employers on CP21, CP22 & CP22A which most of employers fail to comply

IRB is coming to audit employer on

•Tax clearance for resignee

•Notification on new employees

Click here for the real IRB tax audit letter

https://bit.ly/39CwD1Y

Basically these are the documents required in a typical tax audit on employer on CP21, CP22 & CP22A :

•Staff listing

•Form E – Return of C.P.8D

•Form 22

•Form 21

•Form 22A

•Payroll System Data

•Latest of Form 9, 24,49 and 13

•Borang D(Kaedah 13)and Borang A(Maklumat Perniagaan)

•Form EA/EC

Visit us www.ktp.com.my

Visit us www.thks.com.my

How to submit CP21 + CP 22A online via IRB e-SPC.

STEP 1: Go to LHDN Website:(网站)~ Key in New IC number

STEP 2: Key in password

STEP 3: Select e-SPC

STEP 4: Key in Employer’s number

STEP 5: Select Form and Key in accordingly

-

CP22A – Private (私人公司)

-

CP22B – Government (政府)

-

CP21 – Foreign Leaver (外国人)

STEP 7: Select Log Out

Visit us www.ktp.com.my

Visit us www.thks.com.my