Blog

FAQ Malaysian Institute Accountants seminar with HRDF @ 23/03/21

Question 7: Is professional firm considered as employer? (eg: sole-proprietor, partnership and LLP)

Answer:

Yes, all are considered as employer if they have contract of service with employee.

“Employer means any person who has entered into a contract of service to employ any other person as an employee, and includes an agent, manager or factor of such first-mentioned person.”

Question 8: What is the compound for not registering?

Answer:

According to Section 13(2) of PSMB Act 2001, the employer is liable to a fine of not exceeding RM10,000 or imprisonment not exceeding 1 year or both.

Question 9 : How to define employees?

Answer:

It included all the employees who are under “Contract of Service”.

Included: partners from partnership, trainee, part time, non-professional employees (eg: cleaner, coffee lady, receptionist)

Excluded: Internship

“Contract of service means any agreement, whether oral or in writing and whether express or implied, whereby one person agrees to employ another as an employee and that other agrees to serve his employer as an employee, and includes an apprenticeship contract”

Question 10 : Is internship consider under contract of service?

Answer:

No. Internship is not under contract of service.

Question 11 : How to define wages?

Answer:

Wages = salary + fixed allowance. Not include: no fixed allowance, bonus.

“Wages means the basic salary and fixed allowances or other emoluments of a like nature paid in cash by or on behalf of an employer to an employee, and includes any leave pay and arrears of wages but does not include: -

a) any contribution paid by an employer on his own account to any pension fund, provident fund, superannuation scheme, retrenchment, termination, lay-off or retirement scheme, thrift scheme or any other fund or scheme establish for the benefit or welfare of the employee;

b) any travelling allowance or the value of any travelling concession;

c) any sum payable to the employee to defray special expense entailed on him by the nature of his employment;

d) any gratuity payable on discharge or retirement;

e) any bonus or commission; or

f) any allowances paid to apprentice under apprenticeship contract;”

“Monthly wages means the wages paid by an employer to an employee for the whole or part of the month during which the employee id employed by the employer.”

Question 12 : Is director fee subject to HRDF?

Answer:

A director who only receive director fees is not considered as employee.

Question 13 : What are the steps to claim HRDF?

Answer:

Step 1: Send application first and is approved training (registered under HRDF)

Step 2: Approved and attend training (include registered under HRDF and internal training (eg: conduct by manager)

Step 3: Submit complete document for the claim after training (will have a workshop on guiding how to claim)

Question 14 : Any expire date to utilize the fund?

Answer:

Yes, you need to claim the fund within 24 months. Otherwise, it will be forfeited after 24 months from the date of contribution.

Question 15: The levy payment is exempted from March to May 2021. Does it mean the first levy payment is on wages for June 2021 and the payment due date is on or before 15 July 2021?

Answer:

Yes, the company need to pay the levy on salaries from June 2021 onwards. Levy payment to be made no later than 15th of the month.

Question 16 : How much is the rate of levy if number of employees reduce to less than 10? Do I need to notify Corporation?

Answer:

No, you no need to notify Corporation. The rate of levy shall remain at 1% of the monthly wages of each of the employees until the end of the current year.

However, the rate of levy shall be 0.5% if the number of employees remains below 10 after the current year.

[Refer to Section 15(5) and Section 15(6) of PBSM 2001]

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

who is director under the Company Act 2016 ?

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐓𝐇𝐊 (𝐒𝐞𝐜𝐫𝐞𝐭𝐚𝐫𝐢𝐚𝐥, 𝐀𝐜𝐜𝐨𝐮𝐧𝐭/𝐏𝐚𝐲𝐫𝐨𝐥𝐥, 𝐀𝐝𝐯𝐢𝐬𝐨𝐫𝐲)

𝐊𝐓𝐏 (𝐀𝐮𝐝𝐢𝐭, 𝐓𝐚𝐱, 𝐀𝐝𝐯𝐢𝐬𝐨𝐫𝐲)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

𝐅𝐀𝐐 - 𝐌𝐈𝐀 𝐬𝐞𝐦𝐢𝐧𝐚𝐫 𝐰𝐢𝐭𝐡 𝐇𝐑𝐃𝐅 @ 𝟐𝟑/𝟎𝟑/𝟐𝟏

Question 1: Can employer register after 31.03.2021? Say 30.04.2021, as the levy exemption is up to 31.05.2021.

Answer:

No, you need to register not later than 30 days from the effective date of Expansion of Act [i.e. 01.03.2021].

[Refer to Section 13(1) of PSMB Act 2001 and Regulation 4(1) of Pembangunan Sumber Manusia Berhad (Registration of Employers and Payment of Levy (Amendment) Regulation]

To avoid enforcement action by HRDF, you are advised to register before 30.03.2021. (HRDF officer can imposed penalty for non-compliance)

01.03 – 31.05.2021 is only for levy exemption under Section 14 and Section 15 of PSMB Act 2001.

[Refer to PU (A) 84 Pembangunan Sumber Manusia Berhad (Exemption of Levy) order 2021]

Question 2: If company has less than 10 staffs after registered, what can the company do?

Answer:

You can opt to deregister under Section 16(2) of PSMB Act 2001, if you have less than 10 staffs for three consecutive months. You are required to submit application to Corporation for de-registration together with any relevant documents to prove such decrease.

However, you will need to register again if you have 10 staffs in future.

Alternatively, you can continue contribute 1% on remaining 9 staff without deregister. The company is not required to inform if changes in number of workers. The company only need to contribute according to number of remaining staff.

[Refer to Section 15(5) of PSMB Act 2001]

Question 3: If I de-register or I close down my company? Can I get a refund?

No, you will not be refunded.

For de-registration

When an employer is re-registered within a period of two years from the date of deregister, the company shall continue to be eligible to receive financial assistance or other benefits to which the employer was entitled prior to the deregistration.

[Refer to Section 16(2) of PSMB Act 2001]

For closure of company

No balance will be refunded and balance of levy will be transferred to the HRDF General Reserve.

Question 4: Shall HQ register for all branches?

Answer:

Yes, if HQ and all branches under one registration number (ROC/ROB).

But, if HQ and branches are separate entity, then they need to register separately.

Question 5: How about if HQ and branches have different EPF or SOCSO number?

Answer:

HQ can register first, then branches register under HQ. HRDF will assign number to branches like [xxxxx_(Branch 1)], [xxxxx_(Branch 2)]. The company is required to inform HRDF.

Question 6: All employers must submit Form 1 regardless number of employees or even a dormant company?

Answer:

Yes, Form 1 is for a declaration forms and do not tick voluntary register when submit the form.

If you are not liable to register under the Act, the application of Form 1 will be rejected and the employer will receive a rejection letter.

If you failed to submit Form 1 within 30 days, a compound of RM2,000.00 will be imposed.

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Summary of MIA seminar with HRDF on 23/3/2021 Part 1

Summary of MIA seminar with HRDF on 23/3/2021

1. Before 1st March 2021, any activities/industry covered under 1st Schedule

- Manufacturing

- Services

- Mining & Quarrying

2. After 1st March 2021, industry/sectors/activity under 1st Schedule is a mandatory category

- Employer with min 10 local employees

- 1% from total gross salary + fixed allowances

- Section 14 Imposition of levy

P.U (A) 84 Pembangunan Sumber Manusia Berhad (Amendment of first schedule) order 2021

3. Exemption levy payment from 1.3.2021 – 31.5.2021 under P.U (A) 85 Pembangunan Sumber Manusia Berhad (Exemption of levy) order 2021

4. Objective to expansion – increase training opportunities for all employees, to up-skilling, and to prepare a future-ready workforce against technology displacement.

5. Please submit Form 1 even though a dormant company with no staff, just for HRDF record. If not required, they will email to reply to you. Except for voluntary register

How to submit Form 1

Step 1 – Scan all the document as per requirement

Step 2 – go to the HRDF website and click register here

Step 3 – Fill in Form 1 and attached all the information

Step 4 – Click submit

Step 5 – within 7 days process.

Take note:

(i) Details of submission officer

Please put the account email instead of the boss email. Because HRDF maybe clarifies with the submission document.

(ii) Employer Integrity Pledge

No compulsory to be filling.

(iii) Employee with 5-9 Malaysian employees are given the option to register with HRDF

Tick for voluntary registration only. If not, please tick.

6. How do you define employees?

Employee included office boy, coffee lady, receptionist excluded internship.

“Contract of service” means any agreement, whether oral or in writing and whether express or implied, whereby one person agrees to employ another as an employee and that other agrees to serve his employer as an employee and includes an apprenticeship contract

7. What are wages?

- Basic salary + fixed allowance

“Wages” means the basic salary and fixed allowances or other emoluments of like nature paid in cash by or on behalf of an employer to an employee and includes any leave pay and arrears of wages.

Not included any pension fund. Provident fund, retirement fund, retrenchment, termination, any traveling allowance, gratuity, bonus, commission, director fee.

8. How to refund?

- No refund - For striking off the company.

- De-registered –

(i) Has do re-registered within a period of two years from the date of deregister shall continue to be eligible to receive any financial assistance.

(ii) If not re-register within a period of two years, the financial assistance will lose.

Can deregister under Section 14A decrease to below ten for three consecutive months.

9. How to claim?

- The courses need to approve by the HRDF organization.

- The claimable is based on your account balance has a minimum of 50% of the training fee. Disbursement by 2 times when the account has sufficient balance.

10. Any update for new staff or resign staff?

- No need to register and update new staff information in the system. You only required to fill in the total paid 1% of the number of employees during the contribution.

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

How to convert enterprise to sdn bhd?

Registration Procedure:

-

Complete the Registration Form.

-

Every business owner and partners must sign on the registration form.

-

Owner or one of the partners may submit the application over the counter or submit through online via SSM EzBiz Online services in the SSM’s website at www.ssm.com.my.

-

Documents to be attached are as follows:

-

Owner’s and /or partner’s identity card;

-

Original Business Registration Certificate for the change of business type;

-

Supporting document or approval letter from relevant agencies for certain type of business if required by Registrar of Business.

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Duty & responsibility of director

𝐃𝐨 𝐲𝐨𝐮 𝐤𝐧𝐨𝐰 𝐰𝐡𝐚𝐭 𝐢𝐬 𝐭𝐡𝐞 𝐝𝐮𝐭𝐲 & 𝐫𝐞𝐬𝐩𝐨𝐧𝐬𝐢𝐛𝐢𝐥𝐢𝐭𝐲 𝐨𝐟 𝐝𝐢𝐫𝐞𝐜𝐭𝐨𝐫 𝐮𝐧𝐝𝐞𝐫 𝐭𝐡𝐞 𝐂𝐨𝐦𝐩𝐚𝐧𝐲 𝐀𝐜𝐭 𝟐𝟎𝟏𝟔?

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐓𝐇𝐊 (𝐒𝐞𝐜𝐫𝐞𝐭𝐚𝐫𝐢𝐚𝐥, 𝐀𝐜𝐜𝐨𝐮𝐧𝐭/𝐏𝐚𝐲𝐫𝐨𝐥𝐥, 𝐀𝐝𝐯𝐢𝐬𝐨𝐫𝐲)

𝐊𝐓𝐏 (𝐀𝐮𝐝𝐢𝐭, 𝐓𝐚𝐱, 𝐀𝐝𝐯𝐢𝐬𝐨𝐫𝐲)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Convert Enterprise (sole-proprietorship/partnership) to Sdn Bhd Explained. Part 1

Convert Enterprise (sole-proprietorship/partnership) to Sdn Bhd Explained. Part 1

Today we explain the difference between Enterprise and Sdn Bhd comprehensively.

1. Board of director

-

Enterprise : Not required

-

Sdn Bhd : Must have at least one (1) director

2. Liability

-

Enterprise : The owner/partner(s) has unlimited liability and has to take risk in any loss of business fails

-

Sdn Bhd : The shareholder(s) has limited liability. Company becomes separate entity

3. Tax Rate

-

Enterprise : Tax rate for individual income tax between 0% to 30%

-

Sdn Bhd : Annual gross business income not more than RM50 million and paid up ordinary share capital on or less RM2.5million, the tax rate is 17% for first 600K,24% for remaining.

4. Law

-

Enterprise : Regulated under the Business Act 1956

-

Sdn Bhd : Regulated under the Company Act 2016

5. Chargeable person

-

Enterprise : The person is a chargeable person under tax.

-

Sdn Bhd : The company is a chargeable person under tax.

6. Business Management

-

Enterprise : The owner/partner(s) is to manage and run the business.

-

Sdn Bhd : The board of director is to manage and run the business

7. Number of shareholder/owner/partner

-

Enterprise : Sole proprietorship – at least one (1) owner. Partnership – at least two (2) to twenty (20) partners

-

Sdn Bhd : At least one (1) to fifty (50) shareholders

8. Company secretary

-

Enterprise : Not required

-

Sdn Bhd : At least one (1) qualified company secretary

9. Statutory Audit Requirement

-

Enterprise : Not required

-

Sdn Bhd : Yes. Compulsory

10. Annual Compliance

-

Enterprise : Not required

-

Sdn Bhd : Yes. Compulsory to submit annual return and audited financial statement

11. Register Office and Statutory Records

-

Enterprise : Required to keep accounting books and records at the place of business

-

Sdn Bhd : Required to have a registered office within Malaysia which all correspondences & notices may be addressed. Required to keep registers.

12. Income Tax Position

-

Enterprise : Tax on person either the owner or partner(s)

-

Sdn Bhd : Tax on the company.

13. Public Access to Company Financial Situation

-

Enterprise : No need to disclose.

-

Sdn Bhd : Public can access to the financial performance & position of the company

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

FAQ on special deduction for the renovation cost under P.U. (A) 381/2020 (Updated on 11.03.2021) Par

FAQ on special deduction for the renovation cost under P.U. (A) 381/2020 (Updated on 11.03.2021) Part II

Continue from Part I

5. What is the format/form of verification by the external auditors?

Verification of the external auditors needs to be made through a special certificate.

Special certificates can be made in any appropriate format/ form.

6. Is the payment of certification by external auditor is deductible with my R&R expenses?

- No, the fee of certification by external auditor is not included and it is not deductible.

7. Are my expenses for R&R not allowed for special deduction if the cost is more than RM300,000?

- No, you are still entitled for the special deduction is your R&R expenses is more than RM300,000. The maximum to claim is RM300,000 and terms and conditions under P.U.(A) 381/2020 should be applied.

For example:

a) Mr Vincent incurred of RM350,000 for his homestay renovation on 01.06.2020. He is entitled to claim for special deduction for the renovation cost of RM300,000 in YA2020 under P.U.(A) 381/2020. The excess of RM50,000 is not allowed to carried forward.

Mr Vincent incurred for another renovation cost amounting RM150,000 for his homestay renovation in February 2021. Mr Vincent is not entitled to claim special deduction for RM150,000 renovation cost in YA2021 due to he has claimed for the maximum amount of RM300,000 in YA2020.

b) Encik Rahim incurred of RM120,000 for his restaurant renovation on 01.08.2020. He is entitled to claim for special deduction for the renovation cost of RM120,000 in YA2020 under P.U.(A) 381/2020.

Encik Rahim incurred for another renovation cost amounting RM300,000 for his restaurant renovation in July 2021. But Encik Rahim is entitled to claim special deduction for RM180,000 in YA2021 due to he has reached the maximum amount (RM300,000) that he can claim within the period of 01.03.2020 to 31.12.2021.

8. Is the renovation cost cannot be absorbed when the company has adjusted losses?

- Yes, if the renovation cost is not entitled to claim under P.U. (A)381/2020 and cannot be utilised from adjusted income as it is an adjusted loss to the company. The losses can be carried forward and subject to a restricted period under Subsection 44(5F) of ITA 1967.

9. Can I claim the special deduction for the renovation cost if I have also entitled to claim under subsection 33(1) of ITA 1967 or capital allowance under Schedule 2 or Schedule 3?

- No, you are not entitled to claim the special deduction for the renovation cost if you have claimed under subsection 33(1) of ITA 1967 or capital allowance under Schedule 2 or Schedule 3.

10. What supporting document is required?

- The supporting documents should be kept for the required period under ITA 1967 and due to the requirement by LHDN. Supporting documents to be provided including:

i) Business registration certificate

ii) Ownership of the premises (eg: Tenancy agreement)

iii) Invoice for the renovation cost, and

iv) Invoice for the renovation cost which certified by external auditor

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

The offence on any director who contravene the duty & responsibility of directorship

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐓𝐇𝐊 (Account/Payroll, Secretarial & Advisory)

𝐊𝐓𝐏 (Audit, Tax & Advisory)

Tax deduction on cash loss?

Tax deduction on cash loss?

Embezzlement is the act of someone wrongfully appropriating funds that have been entrusted to their care but which are owned by someone else. Many small businesses are victims of thefts perpetrated by employees.

From a tax perspective, can the cash loss eligible for tax deduction?

Let’s illustrate with a simple real case:

Scenario

GGG Sdn Bhd (actual name of the company is conceived to protect confidentiality) has entrusted their account executive on the usage of company’s fund to smoothen the daily operation. However, they have recently found out he has been transferred funds to his accounts over the past 6 months.

The account executive had run away and no way to be found. The total losses are approximately around RM100,000. Without hesitation, GGG had reported to the police.

Struggles

-

Can the cash loss eligible for tax deduction?

-

Is a police report sufficient?

Solution:

Yes, the cash loss is tax-deductible. However, sufficient documentation must be kept. A mere police report is arguably insufficient, as it was only proof that the incident happened.

To avoid further disputes from IRB officer, KTP has advised GGG to prepare more documents as below: -

-

Bank receipts of cash transfer to the account executive current account, letter of employment termination, and bank statement as proof of the person involved.

-

Police report and minutes of the board of directors’ meeting as proof of the action taken.

Sources:

Public Ruling NO. 4/2012 - Deduction for Loss of Cash and Treatment of Recoveries

http://phl.hasil.gov.my/pdf/pdfam/PR_No_4_2012.pdf

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

FAQ (English version) on special deduction for the renovation cost under P.U. (A) 381/2020

FAQ on special deduction for the renovation cost under P.U. (A) 381/2020 (Updated on 11.03.2021)

Expenses incurred (between 1 March 2020 to 31 December 2020) to renovate/refurbish (R&R) the business premises for business purpose are given tax deduction up to a limit of RM300,000.

1. Who is eligible?

To be eligible to claim for tax deduction, shall be subject to the following conditions:

- Any taxpayer who incurred an expense of R&R on business premises.

- The business premises are used for the purpose of its business.

- Deduction is given on the adjusted income under paragraph 4 (a) of the Act Income Tax 1967

2. What is meant with the premise business for this purpose?

All the business premises are either owned or rented by the taxpayer and the premises are used for the purpose of business is eligible.

Example:

(a) Mr. Vincent is the owner of a homestay in Bagan Lalang. During the Movement Control Order (PKP) 2020, Mr. Vincent has costs incurred of R&R on homestays. Expenses of R&R performed by Mr. Vincent for the period of 1 March until 31 December 2020 is eligible for a deduction under P.U. (A) 381/2020 in determining income adjustment of his homestay business for the year of assessment 2020 is subject to the conditions set.

(b) Mr. Rahim rented a shop house for running a restaurant business. During the period Movement Control Order (PKP), the restaurant business was temporarily closed and Mr. Rahim has costs incurred of R&R. Expenses of R&R done by Mr. Rahim is eligible for deduction in determining the income of its subject business to the conditions prescribed under P.U. (A)381/2020.

(c) Hijras Arkitek Sdn Bhd provides services of architectural consultant and has an office in Petaling Jaya. In March 2021, the office has costs incurred of R&R i.e. installing carpets in his office. Hijras Arkitek Sdn Bhd is eligible deductions in determining the income of his business subject to the conditions set out under P.U. (A) 381/2020.

3. What are the eligible and not eligible cost of R&R?

Expenses eligible for tax deduction in the First Schedule P.U. (A) 381/2020:

- General electrical installation

- Lighting

- Gas system

- Water system

- Kitchen fittings

- Sanitary fittings

- Door, gate, window, grill and roller shutter

- Fixed partitions

- Flooring (including carpets)

- Wall covering (including paint work)- False ceiling and cornices

- Ornamental features or decorations excluding fine art

- Canopy or awning

- Fitting room or changing room- Recreational room for employee

- Air-conditioning system

- Children play area

- Reception area- Prayer Room

All the cost involved must be certified by external auditors.

Not eligible costs of R&R are in the Second Schedule P.U. (A) 381/2020:

- Designer fee

- Professional fee- Purchase of antique (purchase of an object or work of art which, represents a previous era in human society, is a collectable item due to its age, rarity, craftsmanship or other unique features and appreciates in value over time)

4. What is the external auditors?

External auditor means a qualified auditor who can confirm the cost incurred by the taxpayer on claims for renovation and renewal costs business premises under P.U. (A) 381/2020.

To be continued…..

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

𝐃𝐨 𝐲𝐨𝐮 𝐤𝐧𝐨𝐰 𝐰𝐡𝐚𝐭 𝐢𝐬 responsibility 𝐨𝐟 𝐝𝐢𝐫𝐞𝐜𝐭𝐨𝐫 𝐮

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐓𝐇𝐊 (Account/Payroll, Secretarial & Advisory)

𝐊𝐓𝐏 (Audit, Tax & Advisory)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

租金收入-税税问与答 Part 2

租金收入-税税问与答 Part 2

纳税人常问关于租金收入的tax问题 :

1.租金收入的税率%是多少?

2.为什么这么高 24%?

3.可以扣除assets?

4.亏损可以带到明年吗?

5.何时对租金收入征税?

Assets 资产

-

Business Income 4(a)

资本津贴可以用于工厂和机器的费用。

Capital allowances can be claimed on capital expenditure incurred on plant and machinery.

-

Investment Income 4(d)

不可以获得资本津贴,但替换家具和空调等家具的费用可以从租赁的总收入中扣除。

Capital allowance cannot be claimed, but cost of replacing furnishings such as furniture and air conditioner can be claimed as a deduction from gross income from that letting.

税收待遇 Tax Treatment

-

Business Income 4(a)

在最初的RM600,000 是17%的税率, 剩下的是24%的税率

First RM600,000 17% Remaining 24%,

-

Investment Income 4(d)

根据PR10/2015第8.2段,投资控股公司可以获得允许的费用如工资、薪金和津贴、管理费等。

Under paragraph 8.2 of PR10/2015, the permitted expenses are allowed by the investment holding company such as wages, salaries and allowances, management fees and etc

参考所得税实践笔记3/2020, 控股公司税率为24%,由2020课税年度起生效

Refer to Practice Note 3/2020, tax rate for investment holding company is 24% effective from year of assessment

根据PR 12/2018第11段, 建筑的拥有人可以获得工业建筑津贴,即使租赁是非商业来源,但建筑用于工业建筑

Under paragraph 11 of PR 12/2018, the owner of the building allowed to claim industrial building allowance even though the letting is a non-business source but the building use for industrial building

营业外收入4(a)变为营业收入4(d) Section 4(a) change to Section 4(d)

无权要求对不动产的设备和机器的资本免税额,因为它们在基本期结束时没有用于商业目的

Not entitled to claim capital allowance on the plant and machinery for the real property since they are not used for business purpose at the end of the basic period.

营业外收入4(d)变为营业收入4(a) Section 4(d) change to Section 4(a)

有权要求对不动产的设备和机器的获得资本津贴,因为它们在基本期结束时用于商业目的。合格费用是指在业务中使用的第一天的市场价值。

Entitled to claim capital allowance on the plant and machinery for the real property since they are used for business purpose at the end of the basic period.

The qualifying expenses is the market value on the first day used in the business.

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

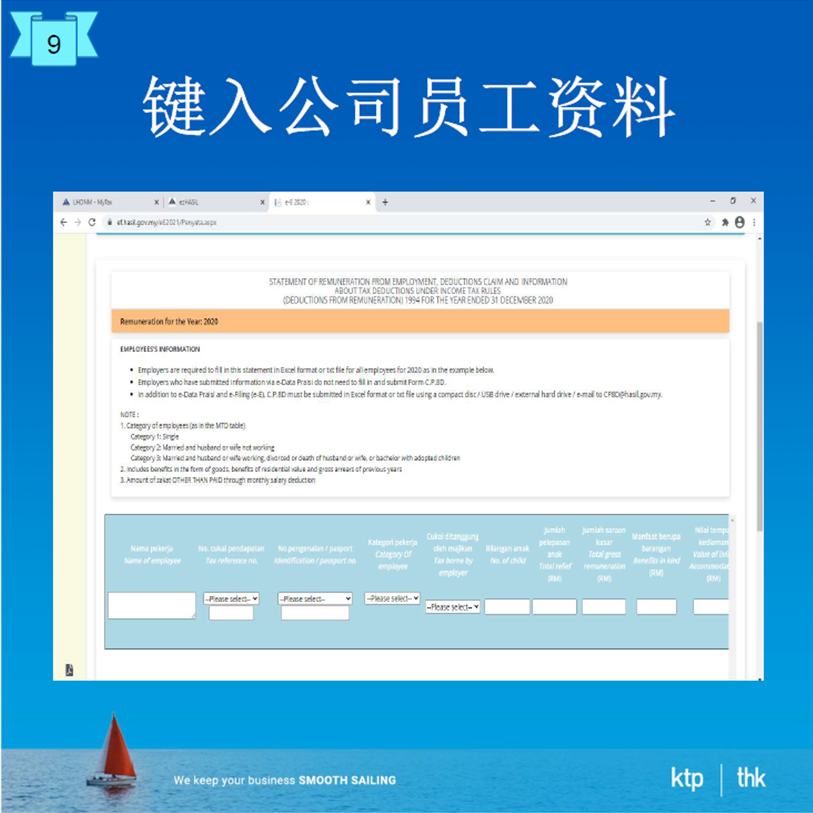

Form E 截至日期为31/03/2021

Form E 截至日期为31/03/2021

罚款

-

RM200至RM20,000

-

入狱少于6个月

-

或两者

温馨提示 -

KTP 只负责处理 Form C, CP204 并不包括Form E, 至于Form E的呈报, 你可以委任 我们的合作伙伴 THK.

谁需要呈报E 表格?

-

有限公司 - 不管是否有员工都必须呈交E 表格

-

合伙公司或个人经营公司 - 如果有员工,必须注册E号码并呈交E表格。

如何呈报E表格?

-

有限公司 - 必须在税务局的官网呈交

-

非有限公司 -

1. 填写E表格然后邮寄到税务局。或者

2. 在税务局的官网呈交(政府非常鼓励线上呈交)

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

KTP Lifestyle (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

THK (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Common traits of shadow director

𝐃𝐨 𝐲𝐨𝐮 𝐤𝐧𝐨𝐰 𝐰𝐡𝐚𝐭 𝐢𝐬 𝐜𝐨𝐦𝐦𝐨𝐧 𝐭𝐫𝐚𝐢𝐭𝐬 𝐨𝐟 𝐬𝐡𝐚𝐝𝐨𝐰 𝐝𝐢𝐫𝐞𝐜𝐭𝐨𝐫 𝐮𝐧𝐝𝐞𝐫 𝐭𝐡𝐞 𝐂𝐨𝐦𝐩𝐚𝐧𝐲 𝐀𝐜𝐭 𝟐𝟎𝟏𝟔?

Share with us the other common traits of the shadow director in the comment section.

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐓𝐇𝐊 (Account/Payroll, Secretarial & Advisory)

𝐊𝐓𝐏 (Audit, Tax & Advisory)

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

Special Reinvestment Allowance 2020 - How/What to claim?

Overview of Special Reinvestment Allowance

An eligible manufacturing and agriculture company is entitled to claim Reinvestment Allowance (RA) and is to be deducted against the statutory income in the basic period for a year assessment.

However, how much is the entitle amount of RA to an eligible company? Any restriction to be applied on RA?

Key takeaways:

You will understand: -

1. The calculation of RA and deduction against statutory income.

2. Basic understanding of non-Application rule.

3. The documents to be prepared to claim RA.

Summary of learning:

1.Tax treatment of special reinvestment allowance

1. An eligible company is entitled to claim RA of 60% on the capital expenditure incurred the year of assessment (YA).

2. But, it will be restricted against 70% of statutory income. Any unabsorbed RA can be carried forward to next YA.

3. With effective from YA 2019, the unabsorbed RA can only be carried forward for a maximum of 7 consecutive years of assessment upon expiry of the qualifying period.

4. Any balance of unabsorbed RA after the end of that seven (7) consecutive years of assessment will be disregarded.

Example:

In YA 2020, ABC Sdn Bhd incurred a total capital expenditure of RM450,000.00 to increase its production capacity. The statutory income (SI) for the year is RM300,000.

How much is the RA claim by the company in YA2020?

Solution:

The tax treatment and calculation is demonstrated as follow:

- RA to be claimed by the company is RM270,000 (60% x RM450,000)

- However, it will be restricted to RM210,000.00 (70% x RM300,000 (SI))

∴ Therefore, the chargeable income to tax of the company in YA 2020 is RM90,000.00 (RM300,000 – RM210,000). The unabsorbed RA of RM60,000 (RM270,000 – RM210,000) will be carried forward to next YA.

2. Non-Application with Special reinvestment allowance

A company claiming RA is not able to enjoy the following tax incentives in the same year of assessment:

-

Pioneer status under the Promotion of Investments Act 1986 (PIA).

-

Investment tax allowances (ITA) under the PIA.

-

Incentive under Investment Incentive Act 1968 (IIA).

-

Industrial adjustment allowance under the PIA in respect of a manufacturing activity or a manufactured product (approval granted prior to the coming into operation of section 27 of the Promotion of Investments (Amendment) 2007 Act [Act A1318].

-

Group Relief for companies under section 44A of the Income Tax Act 1967 (ITA).

-

Deductions under any rules made under section 154 of the ITA.

-

Exemption from tax on income under exemption orders made under paragraph 127(3)(b) or exemption under subsection 127(3A) of the ITA.

3. Claim Procedures for Reinvestment Allowance

1. The eligible company is not required to apply or get written approval from Inland Revenue Board Malaysia (IRBM).

2. However, the company must prepare the RA claim form which can be downloaded from IRBM’s Official Portal.

3. The original copy of the RA claim form shall be kept by the company together with all relevant documents.

Sources:

-

Reinvestment Allowances Part 1 – Manufacturing activity:

http://lampiran1.hasil.gov.my/pdf/pdfam/PR_10_2020.pdf

-

RA claim form:

http://phl.hasil.gov.my/pdf/pdfborang/BORANGTUNTUTANEPS_1.pdf

Visit us

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

KTP Lifestyle (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

THK (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

who is director under the Company Act 2016

𝐃𝐨 𝐲𝐨𝐮 𝐤𝐧𝐨𝐰 𝐰𝐡𝐨 𝐢𝐬 𝐝𝐢𝐫𝐞𝐜𝐭𝐨𝐫 𝐮𝐧𝐝𝐞𝐫 𝐭𝐡𝐞 𝐂𝐨𝐦𝐩𝐚𝐧𝐲 𝐀𝐜𝐭 𝟐𝟎𝟏𝟔?

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

𝐊𝐓𝐏

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.

租金收入-税税问与答 Part 1

-

Wisma 𝐊𝐓𝐏, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma 𝐓𝐇𝐊, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

𝐊𝐓𝐏纳税人常问关于租金收入的tax问题 :

1.租金收入的税率%是多少?

2.为什么这么高 24%?

3.可以扣除assets?

4.亏损可以带到明年吗?

5.何时对租金收入征税?

根据 IRB 公共裁决 Public Ruling第10/2015和第12/2018

如果屋主亲自或委任代理主动提供全面的维修服务 maintenance & support services 在物业上, 那么这个物业租金的收入将归纳于商业收入 (Section 4a business income)。

根据IRB 公共裁决 Public Ruling 第12/2018

如果屋主没有主动或委任代理提供全面的维修服务 maintenance & support services 在物业上, 那么这个物业租赁的收入将归纳于投资收入 (section 4d investment income)

问您 as 房东是否提供主动主动提供全面的维修服务 maintenance & support services 在物业上

If yes… business income

If no … investment income

资本津贴 capital allowance

-

Business Income 4(a)

本年度还没用完的的资本津贴可转至下一年课税年度

-

Investment Income 4(d)

本年度还没用完的的资本津贴不可转至下一年课税年度

业务亏损 Business Loss

-

Business Income 4(a)

允许使用未抵消的业务亏损在下一个课税年度的

-

Investment Income 4(d)

不允许使用未抵消的业务亏损到下一个课税年度的

营业日期 Commencement Date

-

Business Income 4(a)

这取决于房产第一次出租的日期 Depends on the date the real property is rented out for the first time

-

Investment Income 4(d)

这取决于房屋出租的日期 Depends on the date the real property is made available for letting

𝐕𝐢𝐬𝐢𝐭 𝐮𝐬 :

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

𝐊𝐓𝐏 𝐋𝐢𝐟𝐞𝐬𝐭𝐲𝐥𝐞 (Our internal community for our colleagues)

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

𝐊𝐓𝐏 𝐂𝐚𝐫𝐞𝐞𝐫 (Our job platform for interns, graduates & experienced candidates )

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

𝐓𝐇𝐊 (Our associate in secretarial & accounting services)

-

Website www.thks.com.my

-

Facebook http://bit.ly/3duvQ5z

We are one-stop (20 years+ history) audit, tax, secretarial, accounting and payroll firms which commit to help and grow our clients business.